Schlumberger (SLB) Might Be a UFO!

I thought I followed the recipe for Schlumbergers correctly, but apparently you’re not supposed to use petroleum as a cooking oil. This is fine. Today I’ll be discussing another energy company as a potential UFO, but first…

What’s the Word on the Street?

The market is up today despite the Administration ramping up tariff threats again over the weekend, in particular on the EU and Mexico. But instead of threatening retaliation, both said they’d still be negotiating. Investors are betting that the Administrations threats are a tactic, rather than the reality of what’s to come. We’ll see how it plays out as we near the deadline on August 1st.

Schlumberger (SLB)

What Is It?

“Schlumberger Ltd. engages in the provision of energy technology. It operates through the following business segments: Digital and Integration, Reservoir Performance, Well Construction, and Production Systems. The Digital and Integration segment involves the combination of digital solutions and data products with its Asset Performance Solutions. The Reservoir Performance segment consists of technologies and services for productivity and performance optimization. The Well Construction segment includes the full portfolio of products and services for well placement and performance, drilling, and wellbore assurance. The Production Systems segment focuses on the development of technologies and provides services to production and recovery from subsurface reservoirs to the surface, into pipelines, and to refineries. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in Houston, TX. The listed name for SLB is Schlumberger Limited.”

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value and what other option traders expect are the reasons SLB could be a UFO.

What About Recent News?

First off, the biggest news is that SLB earnings releases on Friday (07/18/2025) before the bell. It also recently released a Q2 operational update that revised down its earnings estimates (basically staying flat) due to weaker drilling activity in Saudi Arabia and Latin America. I’m going to assume that’s baked into the current price, so I’m not concerned.

Caution is warranted, but analysts are still optimistic for SLB’s long-term prospects. Earnings releases create a lot of uncertainty, so it might be better to wait for the report. That said, I think there are still some compelling reasons to trade it now.

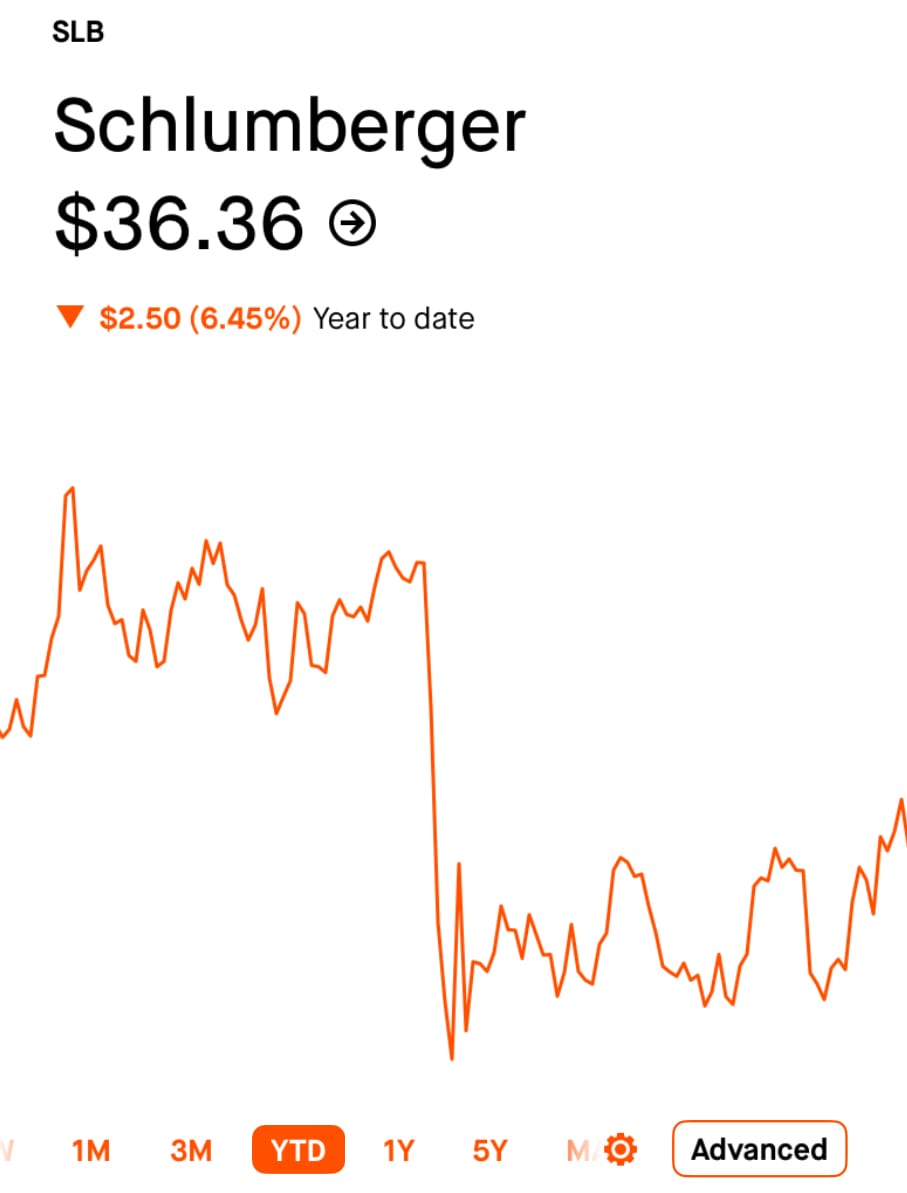

What’s the Current Price?

SLB is currently down today around ~2.5%. It’s down on the year ~6.45% and down ~22.26% for the past year. It’s not really a stock I want to own for a long time, but I think it could be a fine one to hold if my preferred trade goes sideways.

What’s the Fair Value?

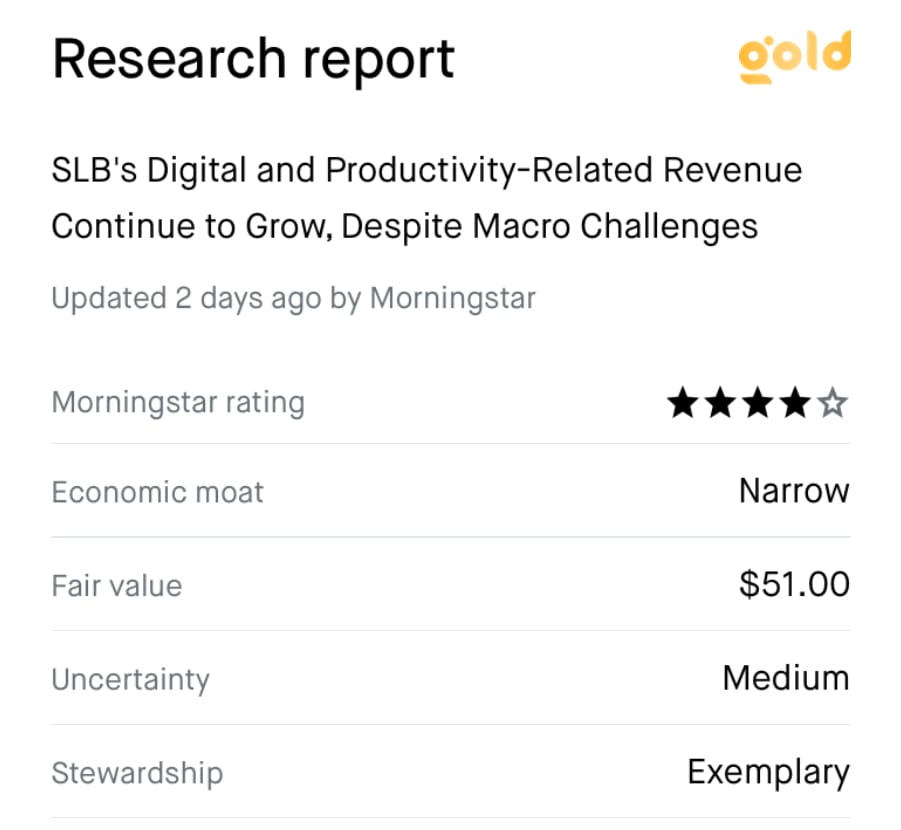

2 images showing analyst fair value estimates for SLB

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

SLB’s most recent earnings report was on 04/25/2025, but this time I’m going to do something different. SLB released their operational update on 06/24/2025, so I’m only going to factor the ratings since that date. That said, it has received 6 ratings and taking the average the fair value might be somewhere around: $47 (Actually $47.33, but I’m rounding down). All ratings are a buy. The lowest being $44, the highest being $53.

What Do Options Traders Think?

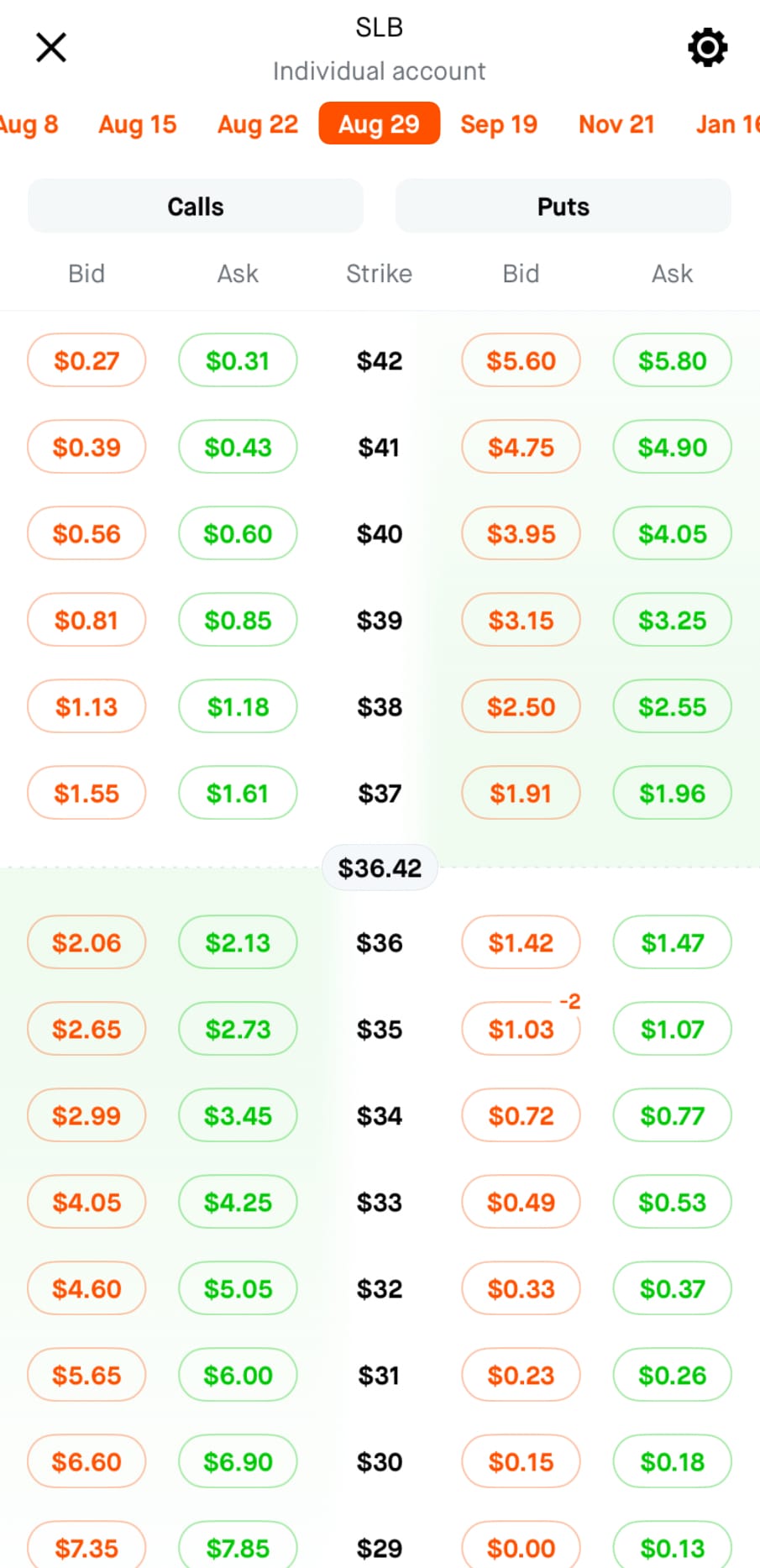

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $35 put it says $1.03, it’s $1.13 for the equidistant call at $38.

The premium (the credit you receive for executing the trade) is currently less for selling puts, as opposed to selling calls. Basically because of that, option traders expect the stock to go up, rather than down.

What’s the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

SLB does offer a dividend and the yield is pretty good at 3%.

So if you saw the most recent image above, I already STO (sold to open) 2 contracts of the $35 put for the August 29th expiration. I like to have a DTE (Days to Expiration) that is around ~45 days. I typically don’t like to get a strike price so close to ATM (at the money (the current price of the stock)), but I decided it was a good trade and the collateral requirement was fairly low.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosure

- I currently have open trades with SLB (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.