Marvell Technology (MRVL) Might Be a UFO!

The new Fantastic Four movie is releasing in theaters this week, but is it too late to audition for the team? We can be the Fantabulous Five!

I know it’s Marvell the chip stock and not Marvel the superhero company. I wrote about it recently, and after closing that trade a while ago, I’m back at it again! But before I talk about that…

What’s the Word on the Street?

The market is up today and we’re at all time highs again. There aren’t any major data releases this week, so investors are focusing on earnings instead. A large majority of companies that have reported thus far have beaten expectations. That’s good news, but tariffs are still a concern and there hasn’t been much news in the way of trade deals. The deadline of August 1st is quickly approaching!

Marvell Technology (MRVL)

What Is It?

Marvell Technology, Inc. engages in the design, development, and sale of integrated circuits. Its products include data processing units, security solutions, automotive, coherent DSP, DCI optical modules, ethernet controllers, ethernet PHYs, ethernet switches, linear driver, PAM DSP, transimpedance amplifiers, fibre channel, HDD, SSD controller, storage accelerators, ASIC, and Marvell government solutions. It operates through the following geographical segments: United States, Singapore, Israel, India, China, and Others. The company was founded by Wei Li Dai and Pantas Sutardja in 1995 and is headquartered in Wilmington, DE. The listed name for MRVL is Marvell Technology, Inc. Common Stock.

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value, what other option traders expect, and recent trends in AI spending are the reasons MRVL could be a UFO.

What About Recent News?

Marvell is a company that benefits from the AI chip race, which doesn’t appear to be slowing down. Companies are still spending large amounts of cash on AI advancements and integrations.

The only news specifically for MRVL is that there were leadership changes last week aimed at boosting investor confidence.

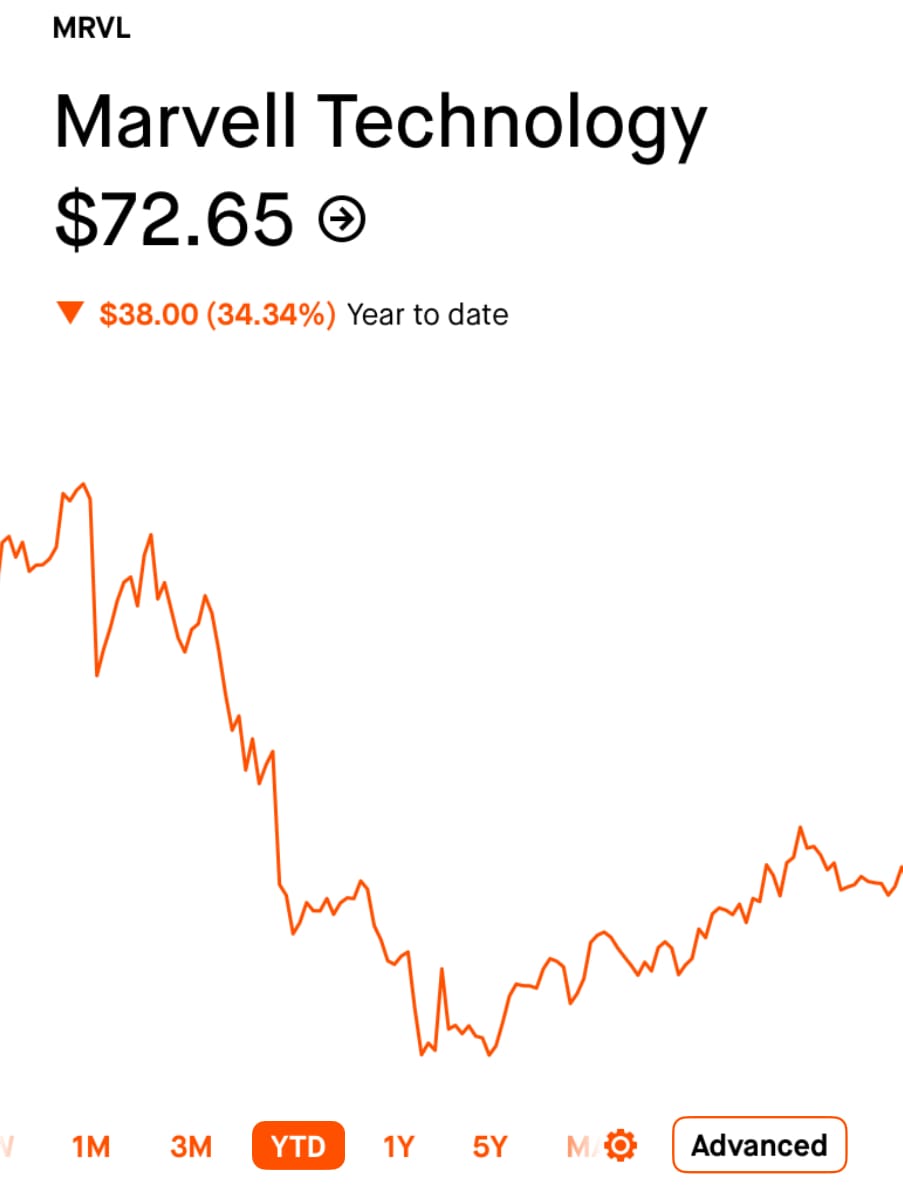

What’s the Current Price?

MRVL might be down on the year compared to a rival like NVDA (up ~26% YTD), but that doesn’t mean MRVL is a dud. In the past 3 months MRVL has risen ~45%. It’s down today and has been basically flat for the month, so I thought it might be worth trading again.

What’s the Fair Value?

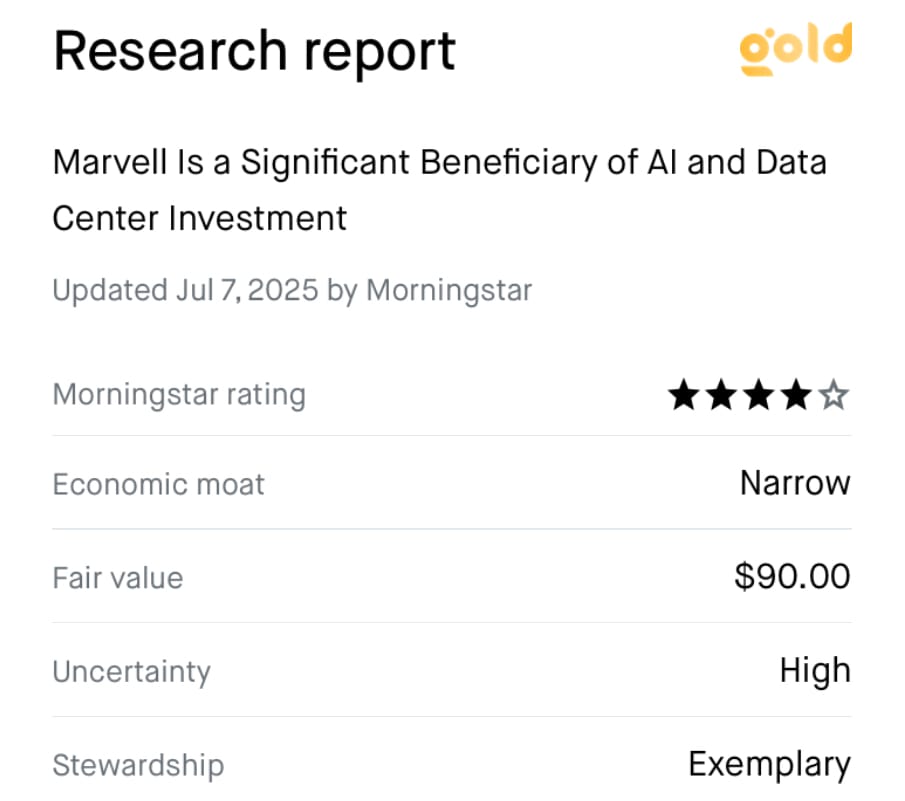

2 images showing analyst fair value estimates for MRVL

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since MRVL’s most recent earnings report on 05/29/2025, it has received 20 ratings and taking the average, the fair value might be somewhere around: $93. 14 ratings are a buy, 5 are a hold, and the other from Morningstar is not displayed. The lowest rating is $60, the highest is $133.

What Do Options Traders Think?

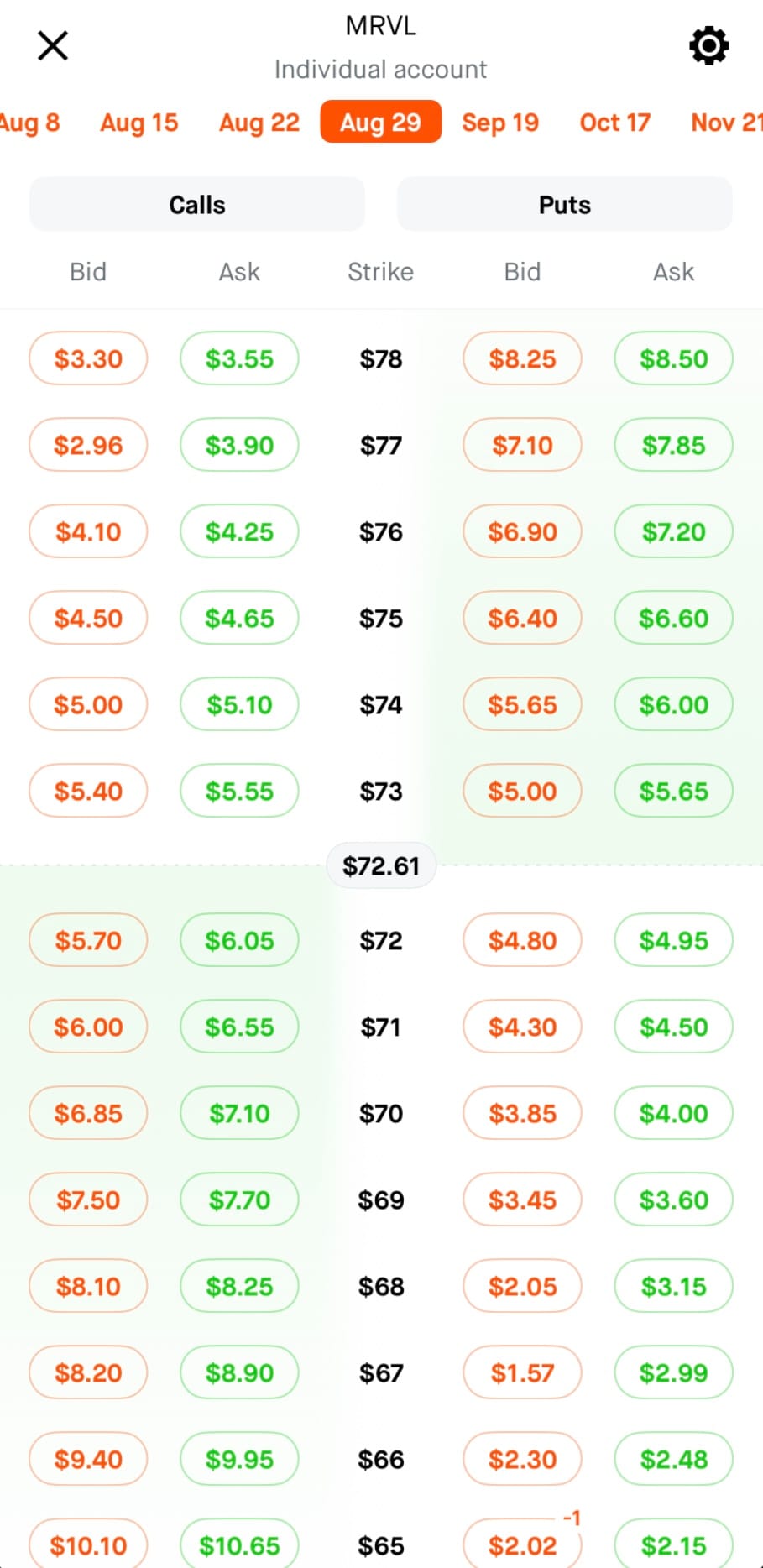

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $70 put it says $3.85, it’s $4.50 for the equidistant call at $75.

The premium (the credit you receive for executing the trade) is currently less for selling puts, as opposed to selling calls. Basically because of that, option traders expect the stock to go up, rather than down.

What’s the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

MRVL does offer a dividend with a yield of 0.32%.

So if you saw the most recent image above, I already STO (sold to open) 1 contract of the $65 put for the August 29th expiration. I like to have a DTE (Days To Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

What About Alternative Trade Ideas?

- If the collateral requirement is too high, another idea is a put credit spread. You would sell a put at a strike below the current share price and then buy a put at a lower strike than the put you sold. By doing so, you will avoid the collateral requirement of a cash-secured put, but the credit received will be smaller. Also, if the trade goes sideways, you will not be assigned shares so no collecting dividends and running covered calls afterwards.

- Just invest! 1 share or even fractional shares are a way to get a foothold in a stock that you think might increase in value.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosure

- I currently have open trades with MRVL (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.