Intuitive Machines (LUNR) Might Be a UFO!

You’re telling me there’s a big ball of cheese in the sky? That must be a UFO!

I actually traded LUNR earlier this week and saw it appear again on my scanner this morning, so I’m currently trying to get another order filled. But before I get to that…

What’s the Word on the Street?

All major indexes are up and the market is set to end on a positive note for the week. Earnings so far have been solid and there seems to be progress on trade deals.

That said, there’s a lot happening next week. More earnings of course, but also the Fed’s rate decision on Wednesday (most likely keeping rates where they are (much to the chagrin on the President)) and the monthly jobs report on Friday. Not to mention the big deadline for trade deals is also set for Friday.

Intuitive Machines (LUNR)

What Is It?

Intuitive Machines, Inc. is a space exploration, infrastructure, and services company, which engages in contributing to the establishment of cislunar infrastructure and helping to develop cislunar and deep space commerce. It offers space products and services. The company was founded by Stephen J. Altemus, Kam Ghaffarian, and Timothy P. Crain in 2013 and is headquartered in Houston, TX. The listed name for LUNR is Intuitive Machines, Inc. Class A Common Stock.

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value and what other option traders expect are the reasons LUNR could be a UFO.

What About Recent News?

There hasn’t been a lot going on for LUNR lately. An analyst did downgrade the stock last week, but the space industry has been growing and the stock price for LUNR and other related companies have grown along side it (more on that later).

LUNR has won contracts, including one with NASA estimated to be worth 4.82 billion to help with their Near Space Network. That was already reported last year so that’s definitely baked into the price of the stock. But there could be other contract announcements later this year or next year.

Also last year, Intuitive Machines became the first company to send a commercial lander to the moon’s surface. It’s continued to work on other missions since then.

Finally, I’d like to speculate that with the falling out between the President and the CEO of SpaceX, there could be more contracts to go around in the future for other space-related companies.

What’s the Current Price?

LUNR is down on the year, but in the past year the stock has risen ~204%. In the past 3 months it’s up ~50% and in the past month alone it’s up ~20%. That’s a lot, but there might still be more fuel in the rocket.

What’s the Fair Value?

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since LUNR’s most recent earnings report on 05/13/2025, it has received 4 ratings and taking the average, the fair value might be somewhere around: $15.25.

2 ratings are a Buy, 1 is a Hold, 1 is a Sell. The lowest price target is $10.50, while the highest is $21.50.

What Do Options Traders Think?

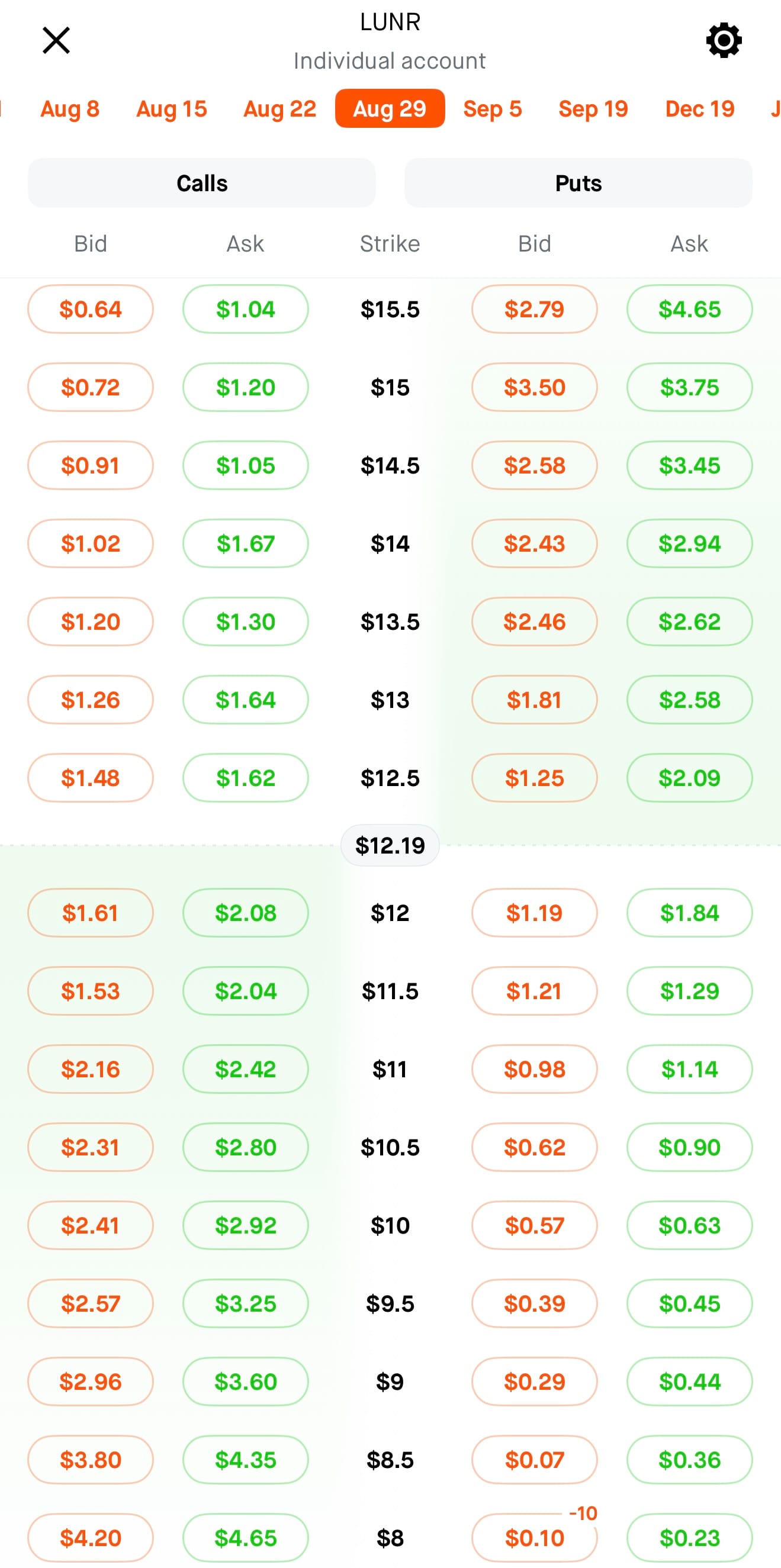

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $11 put it says $0.98, it’s $1.20 for the equidistant call at $13.5.

The premium (the credit you receive for executing the trade) is currently less for selling puts, as opposed to selling calls. Basically because of that, option traders expect the stock to go up, rather than down.

How About Volatility?

The IV rank (the purple line) for LUNR (stock price in blue) is currently hovering around 24.18, which is not very high (IV Rank goes from 0-100). This makes short strategies (which are what I prefer) not as attractive as I'd like, but it's still tradable.

What's the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

LUNR does not offer a dividend. But that’s not a dealbreaker!

So if you saw the most recent image above, I already STO (sold to open) 10 contracts of the $8 put for the August 29th expiration. I like to have a DTE (Days To Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

What About Alternative Trade Ideas?

- If the collateral requirement is too high, another idea is a put credit spread. You would sell a put at a strike below the current share price and then buy a put at a lower strike than the put you sold. By doing so, you will avoid the collateral requirement of a cash-secured put, but the credit received will be smaller. Also, if the trade goes sideways, you will not be assigned shares so no collecting dividends and running covered calls afterwards.

- Just invest! 1 share or even fractional shares are a way to get a foothold in a stock that you think might increase in value.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosures

- I currently have an open trade with LUNR (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.