Galaxy Digital (GLXY) Might Be a UFO!

After my home mysteriously burned down yesterday, I was looking for a new place to live and I think I might have spotted a UFO! Please ignore the vehicle I'm piloting, flying saucers definitely aren't UFOs! It‘s just the new…uhh…Cybersaucer? Anyway…

Galaxy Digital appeared on my scanner for the first time this morning, so I was intrigued. After doing some analysis, I decided it might make for a good trade! But first...

What’s the Word on the Street?

The market is mixed today. The CPI (consumer price index) released this morning and came basically in-line with expectations, but an increase from May levels. This sent the Dow and Russell down, while the S&P stayed relatively flat. The Nasdaq is up largely because of Nvidia being allowed to sell their H20 chips to China.

There are increased worries that the tariffs that were implemented (10% on almost every country) earlier this year are starting to show up in inflation readings such as the CPI released today. We’ll know more as more data releases. In the meantime, there are still UFOs to trade! And today is…

Galaxy Digital (GLXY)

What Is It?

Galaxy Digital, Inc. engages in digital assets and data center infrastructure, delivering solutions that accelerate progress in finance and artificial intelligence. It operates through the following segments: Digital Assets and Data Centers. The digital assets segment offers institutional access to trading, advisory, asset management, staking, self-custody, and tokenization technology. The Data Centers segment competes with a range of infrastructure providers that are building or repurposing facilities to support the rapidly growing demand for AI and compute-intensive workloads. The company was founded by Michael Novogratz in 2018 and is headquartered in New York, NY. The listed name for GLXY is Galaxy Digital Inc. Class A Common Stock.

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value, what other option traders expect, and its volatility are the reasons GLXY could be a UFO.

What About Recent News?

Interestingly, GLXY was first made public in May and is currently sitting below its IPO price. There isn't anything specifically new for this particular company, but there is currently a lot going on with digital assets.

This week is "crypto week" on Capitol Hill, which will have lawmakers vote on bills related to more favorable treatment of cryptocurrency. In the meantime, many cryptocurrencies have lifted in value in anticipation, especially Bitcoin reaching all-time highs (it's since fallen a bit below). There could be a "buy the rumor, sell the news" thing happening, so some caution is warranted.

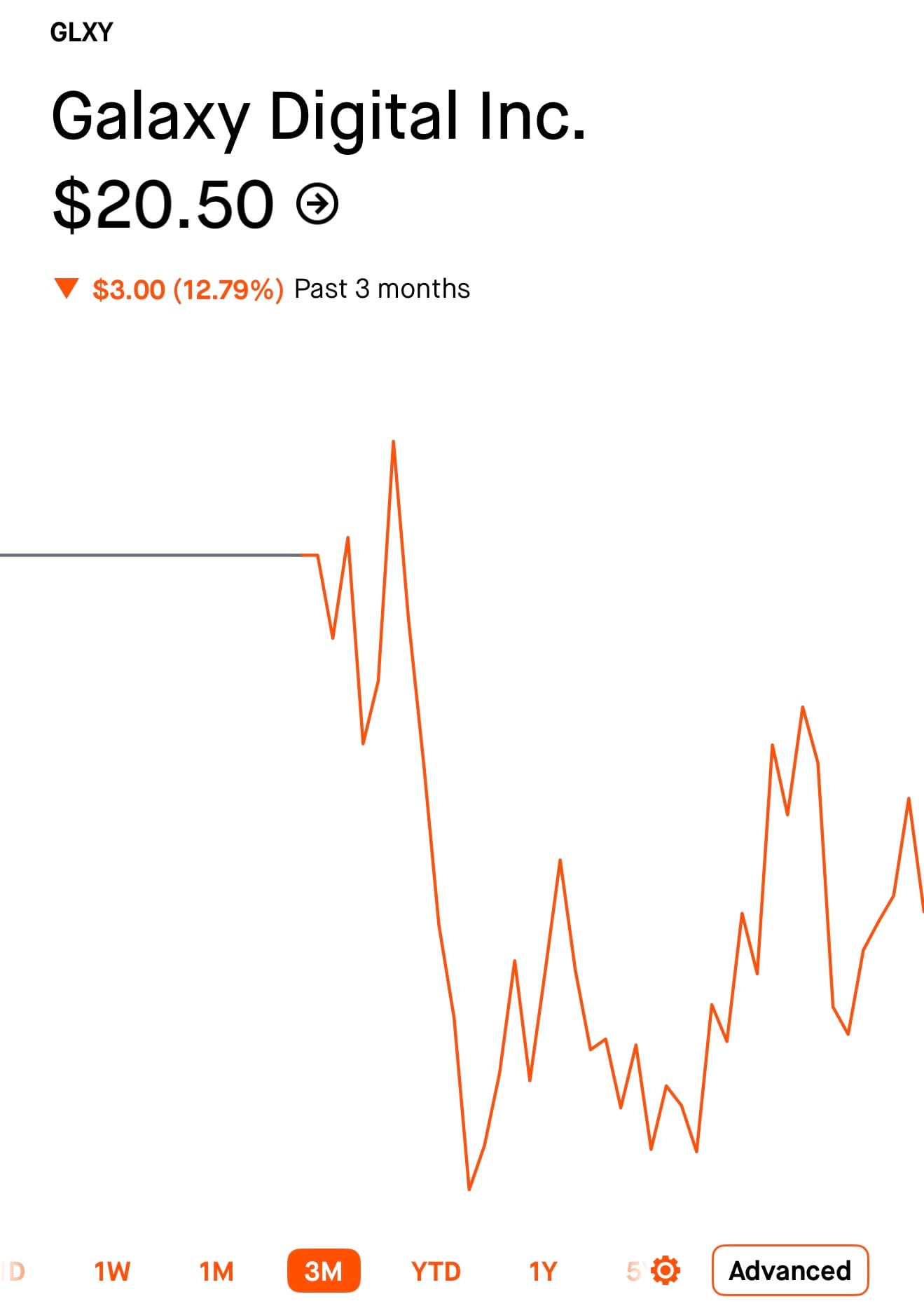

What’s the Current Price?

Like I mentioned before, GLXY was only recently listed in May, so it doesn't have a lot of history. It's currently sitting at $20.50 and has fallen ~$3 from its IPO price.

What’s the Fair Value?

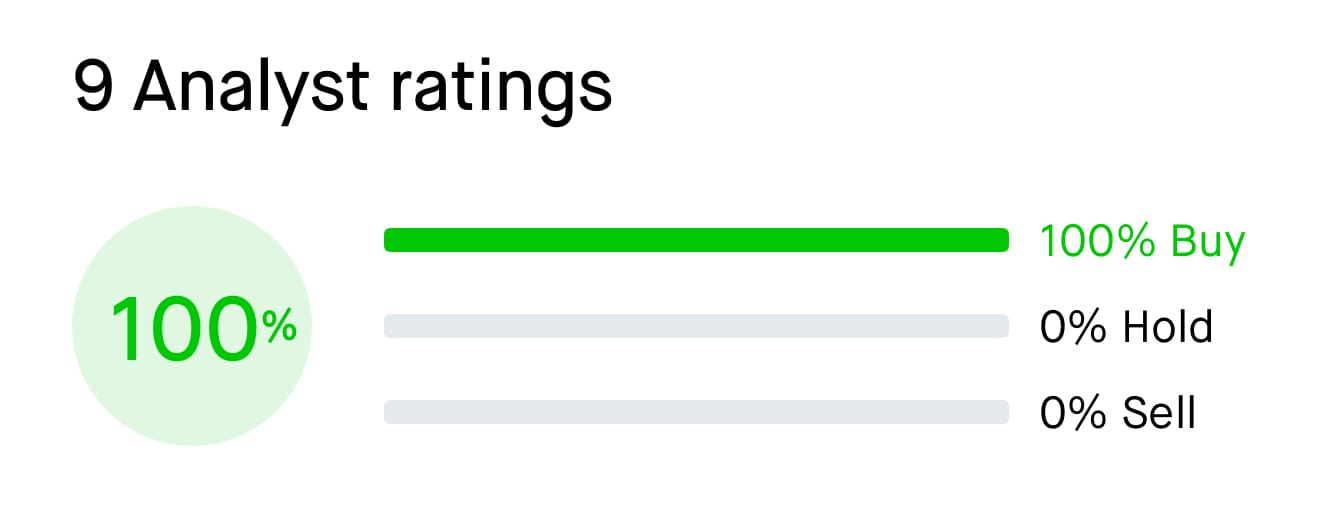

Two images showing analyst fair value estimates for GLXY

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

GLXY has never reported earnings yet, so I will take all the ones I have access to currently. According to my brokerage there are 9 analyst ratings that are all rated a buy. But, on Unusual Whales, I only see 4, 2 of which have price targets and the other 2 are somehow before the stock was listed and have no price targets (let’s ignore those…). That said, the average would make the fair value somewhere around $29. The lowest being $25 and the highest being $33.

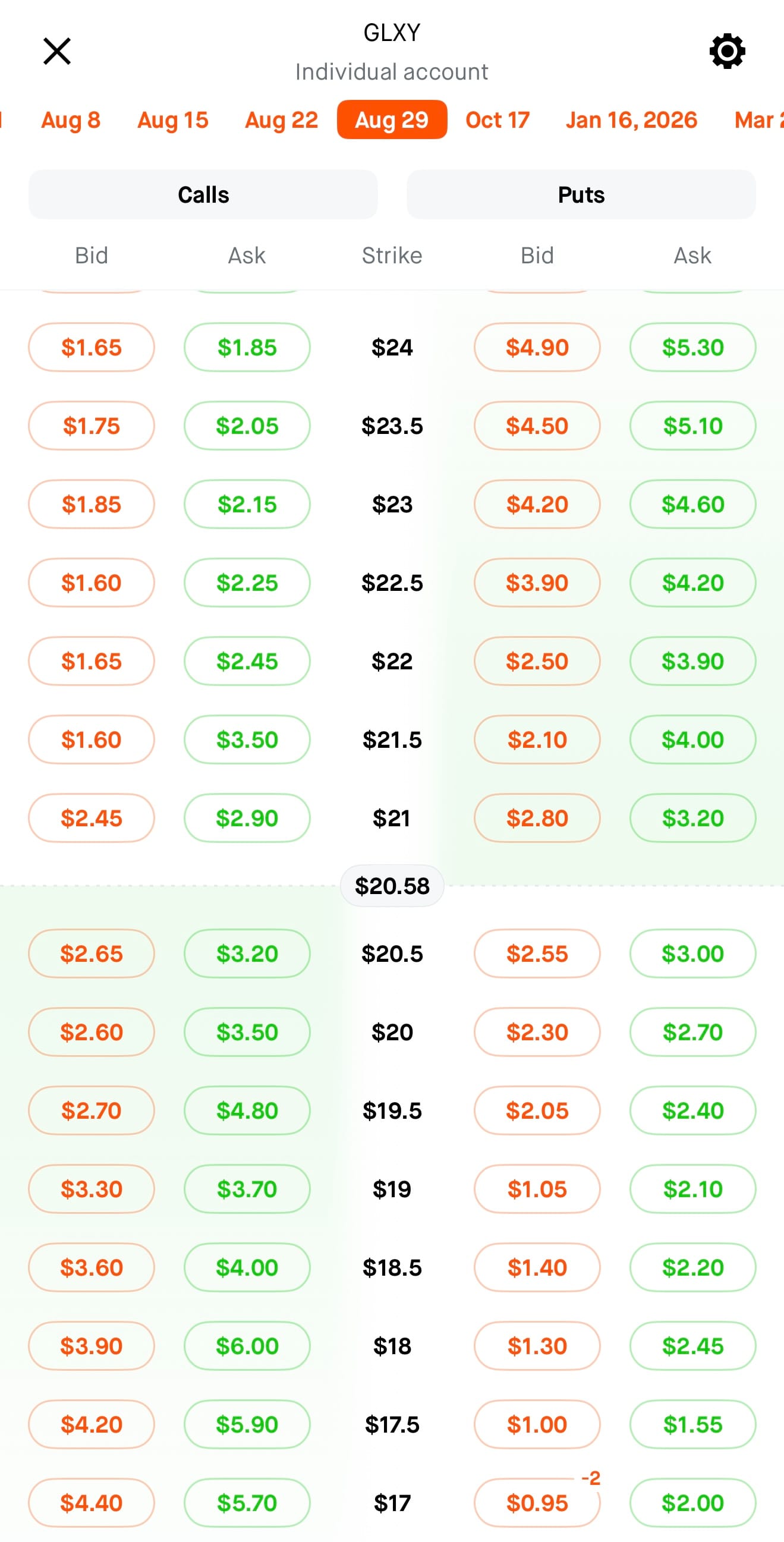

What Do Options Traders Think?

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $19 put it says $1.05, it’s $1.60 for the equidistant call at $22.50.

The premium (the credit you receive for executing the trade) is currently less for selling puts, as opposed to selling calls. Basically because of that, option traders expect the stock to go up, rather than down.

How About Volatility?

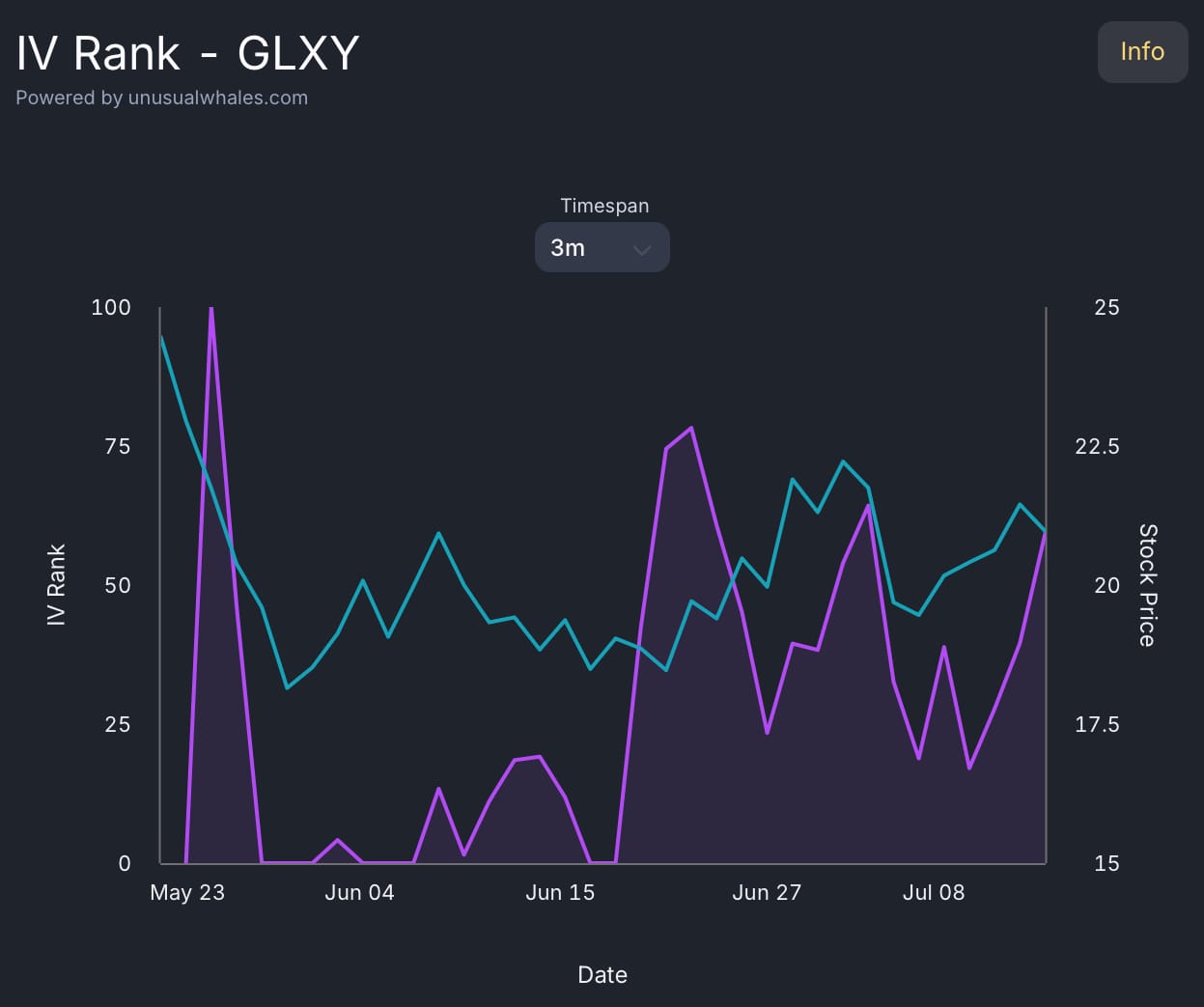

The IV rank for GLXY is currently hovering around 59.28, which is fairly high. This makes short strategies (which are what I prefer) attractive.

What’s the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

GLXY does not offer a dividend since it's a newly listed small-cap company. But the stock price is cheap, which means the collateral requirement is low.

So if you saw the most recent image above, I already STO (sold to open) 2 contracts of the $17 put for the August 29th expiration. I like to have a DTE (Days to Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

What About Alternative Trade Ideas?

- If the collateral requirement is too high, another idea is a put credit spread. You would sell a put at a strike below the current share price and then buy a put at a lower strike than the put you sold. By doing so, you will avoid the collateral requirement of a cash-secured put, but the credit received will be smaller. Also, if the trade goes sideways, you will not be assigned shares so no collecting dividends and running covered calls afterwards.

- Just invest! 1 share or even fractional shares are a way to get a foothold in a stock that you think might increase in value.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosure

- I currently have open trades with GLXY (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.