D-Wave Quantum (QBTS) Might Be a UFO!

Wait a minute…QBTS? I thought you said BTS! AKA D-Wave Quantum, is a quantum computing company and it also might be a UFO! But first…

What’s the Word On the Street?

The trade war is back on! It never really left, it’s just been in the backseat for a little bit. But now it’s back in the front seat! Yesterday the market was down a bit because of the Administration announcing new tariff rates for the countries that haven’t made deals yet. It’s notable that the market wasn’t down as much as one might expect, probably because investors are hoping that if something bad were to happen to the economy, the Administration would eventually back down. This was what was referred to as the TACO trade recently (Trump Always Chickens Out). Plus, these new tariff rates aren’t set to take effect until August 1st, which means there’s still time to make deals! …right?

Regardless, the market is rebounding a bit today, but it’s largely the Russell going up the most. I noticed quantum computing stocks were mostly down today, and wanted to scoop up some IONQ, but couldn’t find a price I liked. I decided to go for QBTS instead (also looking at Rigetti Computing, Inc. (RGTI), but decided to focus on one quantum computing company for the moment).

D-Wave Quantum (QBTS)

What Is It?

“D-Wave Quantum, Inc. engages in the development and delivery of quantum computing systems, software, and services. It provides customers with access to the company’s quantum computing systems via the cloud in the form of quantum computing as a service. It offers professional services such as customer assistance in identifying and implementing quantum-computing applications. The company was founded on January 25, 2022 and is headquartered in Palo Alto, CA.”

Why Is It a Possible UFO?

Several reasons! Its current share price relative to its fair value, what other option traders expect, and recent news are the highlights.

What About Recent News?

Quantum computing is still a technology in its infancy. D-Wave Quantum was only recently founded in 2022. It recently sold stock to fund its efforts at accelerating innovation in the space.

It should be noted that D-Wave hasn’t been the only quantum company raising funding, but it has touted its supremacy and is seen by analysts to be the one with the best chance of gaining profitability before its peers.

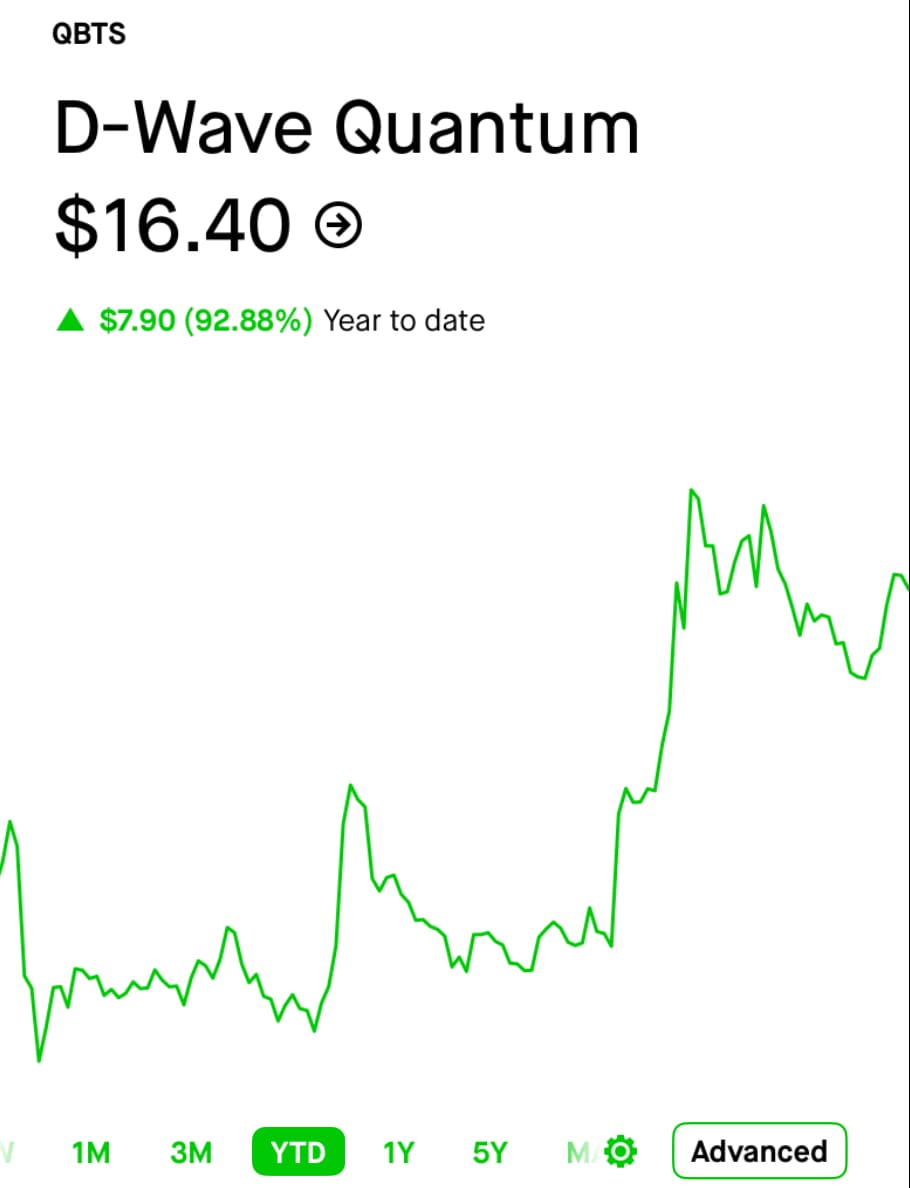

What’s the Current Price?

I’ll admit, QBTS has gone up a significant amount so far this year. I typically stay away from these sorts of stocks because just as quickly as stocks rise, they can also fall just as fast or even faster. That said, QBTS is currently down ~2% today at the price of $16.40/share. It’s had quite the ride recently having gone up ~10% in the past week, down ~7.5% in the past month, up ~130% in the past 3 months, and up a staggering ~1,369% in the past year (yes thousand!).

What’s the Fair Value?

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since QBTS’s most recent earnings report on 05/08/2025, it has received 5 ratings and taking the average the fair value might be somewhere around: $17 (Actually $17.4, but I’m rounding down). All 5 ratings are a buy.

What Do Options Traders Think?

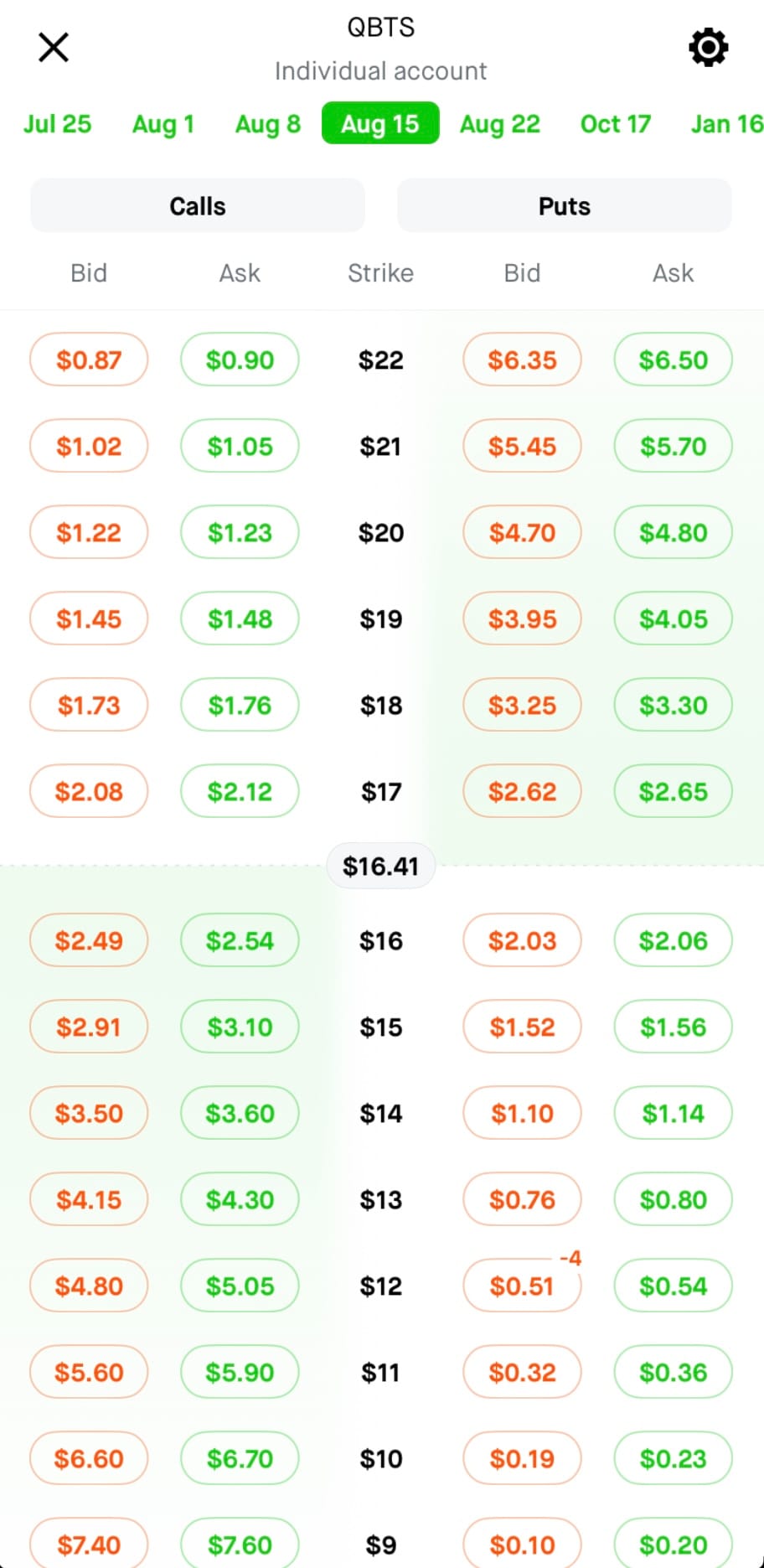

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $12 put it says $0.51, it’s $1.02 for the equidistant call at $21.

The premium (the credit you receive for executing the trade) is currently less for selling puts, as opposed to selling calls. Basically because of that, option traders expect the stock to go up, rather than down.

What’s the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

QBTS does not offer a dividend. It’s a small cap company with no profitability yet. But the stock is relatively cheap and quantum computing will probably become more ubiquitous in the future.

So if you saw the most recent image above, I already STO (sold to open) 4 contracts of the $12 put for the August 15th expiration. I like to have a DTE (Days to Expiration) that is around ~45 days. I know the August 22nd DTE is closer to 45 days, but there is more volume for the third Friday of the month right now.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosure

- I currently have open trades with QBTS (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.