Chipotle (CMG) Might Be a UFO!

I've gone back to Chipotle and instead of getting my normal burrito order, I decided to get it in a bowl! I'm not sure how it makes it better, but it might be a UFO! But before I discuss that...

What's the Word on the Street?

The market is up today as investors brace for Nvidia's earnings after the closing bell. We'll get to see how companies are spending on their AI efforts and if there's a slowdown. China has been reportedly dissuading domestic companies against purchasing Nvidia chips, so that might need to be factored into their results. It's a highly anticipated report because tech has really been leading the current rally and if tech's MVP starts to falter, so too might the rally.

Chipotle (CMG)

What Is It?

Chipotle Mexican Grill, Inc. engages in the business of developing and operating restaurants that serve a relevant menu of burritos, burrito bowls, quesadillas, tacos, and salads made using fresh, high-quality ingredients. The company was founded by Steve Ells in 1993 and is headquartered in Newport Beach, CA. The listed name for CMG is Chipotle Mexican Grill, Inc.

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value and what other option traders expect are the reasons CMG could be a UFO.

What About Recent News?

Chipotle's Q2 results showed a 4% drop in same-store sales and flat guidance for the year.

Management and analysts point to consumer pushback on value and rising competition from cheaper rivals. These worries continue to weigh on the stock.

Chipotle just announced a partnership with student athletes at Ohio State, Florida, and Georgia, giving them free meals. This move targets brand exposure and aims to connect with younger consumers. The news is fresh but has not sparked a major price reaction so far.

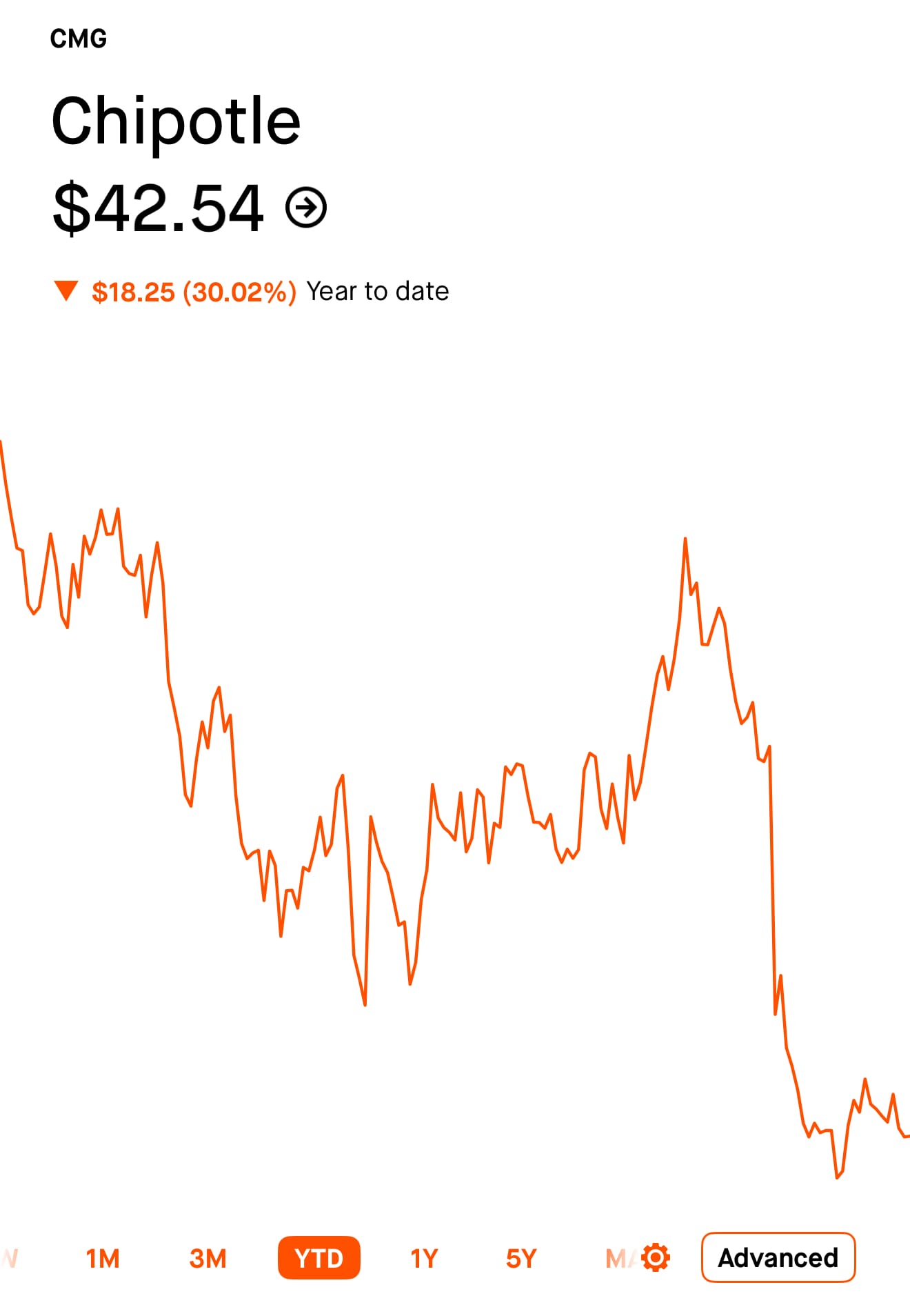

What's the Current Price?

CMG has not had a good run so far this year. Most of that fall (17%) was in the past 3 months. But it's still down on the month at ~7% and on the week at ~1%. CMG was fluctuating a bit this morning and was down initially before beginning to rise a bit. The stock appears oversold to me, but might take time and/or a catalyst for it to recover.

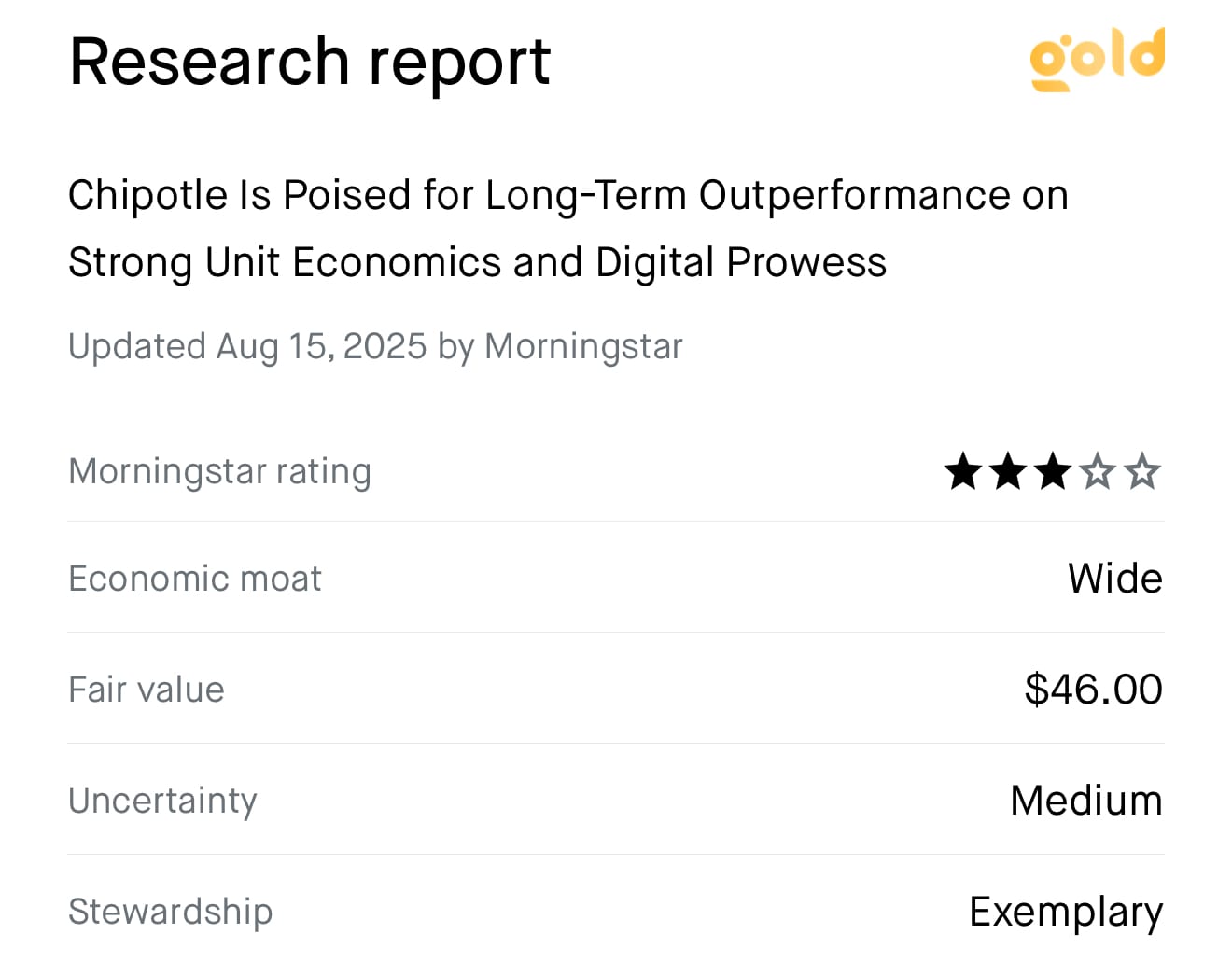

What's the Fair Value?

Analysts fair value ratings for CMG

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since CMG's most recent earnings report on 07/23/2025, it has received 11 ratings and taking the average, the fair value might be somewhere around: $54.64.

6 ratings are a Buy, 4 are a Hold, and the Morningstar rating is unknown. The lowest price target is $46, while the highest is $60.

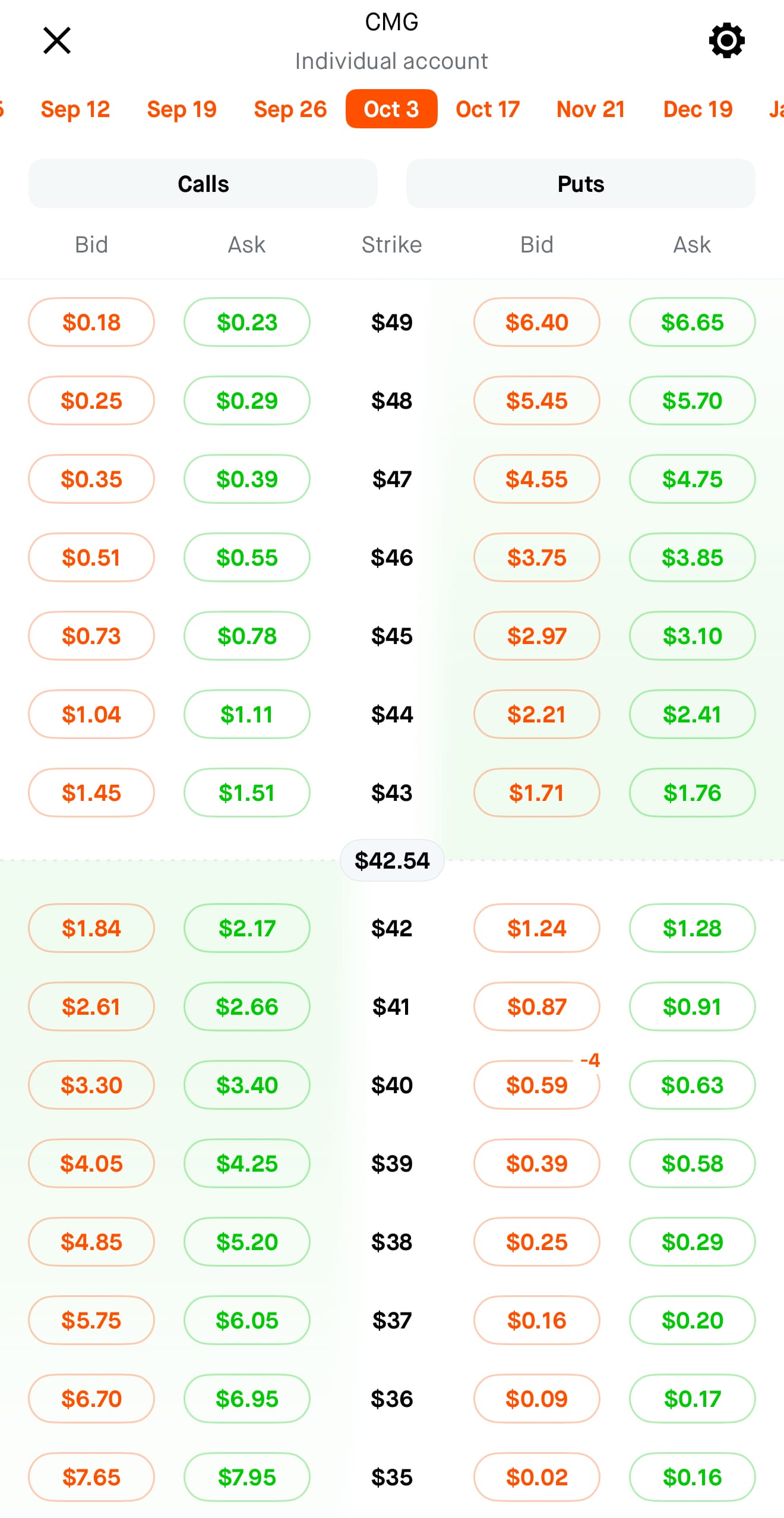

What Do Options Traders Expect?

Calls are trading over equidistant Puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $40 Put it says $0.59, it’s $0.73 for the equidistant Call at $45.

The premium (the credit you receive for executing the trade) is currently less for selling Puts, as opposed to selling Calls. Basically because of that, option traders expect the stock to go up, rather than down.

How About Volatility?

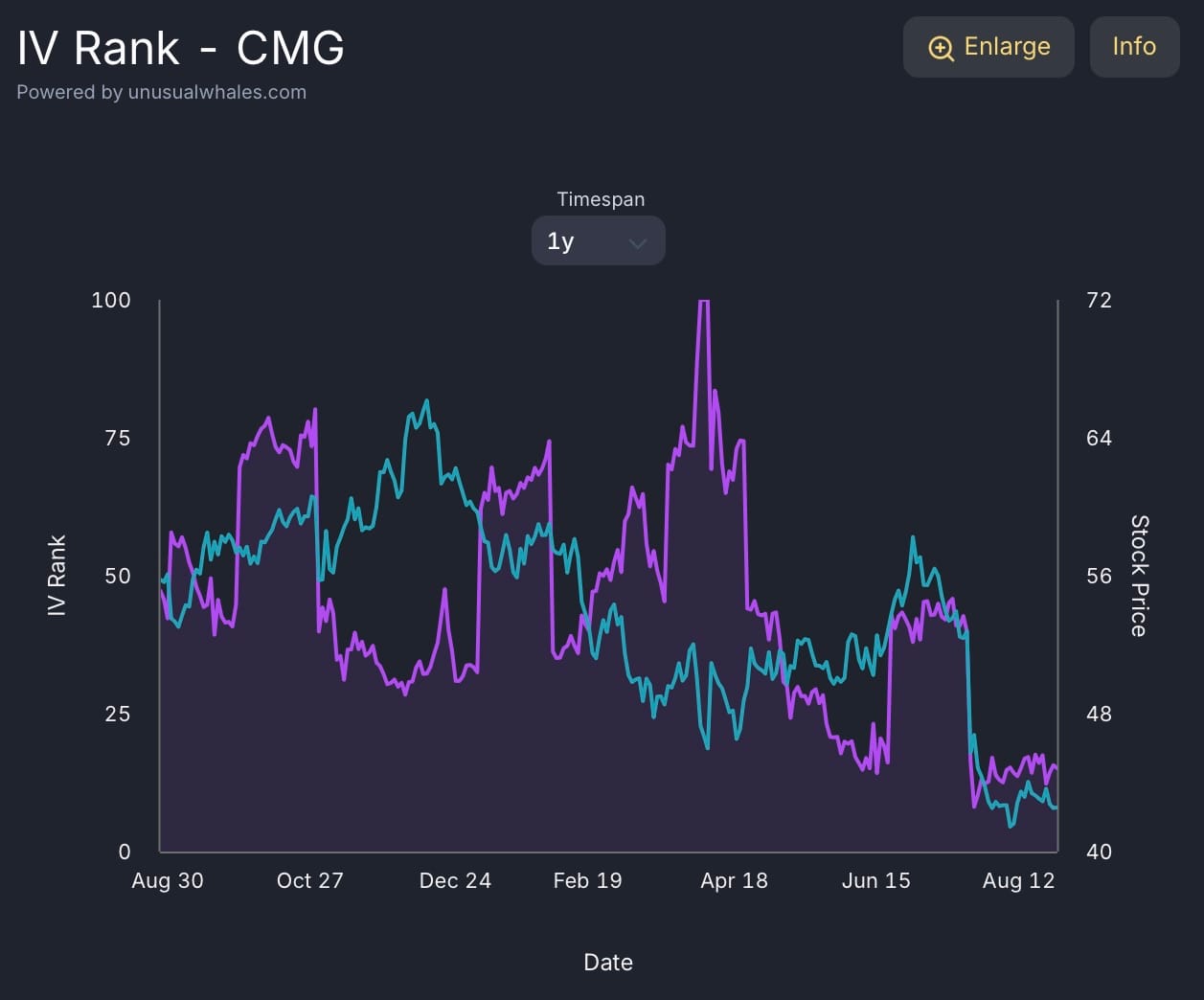

The IV rank (the purple line) for CMG (stock price in blue) is currently hovering around 15.13, which is pretty low (IV rank goes from 0-100). This makes short strategies (which are what I prefer) less attractive.

What's the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

CMG does not offer a dividend, but that’s not a dealbreaker!

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

So if you saw the most recent image above, I already STO (sold to open) 4 contracts of the $40 Put for the October 3rd expiration. I like to have a DTE (Days To Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

What About Alternative Trade Ideas?

- If the collateral requirement is too high, another idea is a put credit spread. You would sell a put at a strike below the current share price and then buy a put at a lower strike than the put you sold. By doing so, you will avoid the collateral requirement of a cash-secured put, but the credit received will be smaller. Also, if the trade goes sideways, you will not be assigned shares so no collecting dividends and running covered calls afterwards.

- Just invest! 1 share or even fractional shares are a way to get a foothold in a stock that you think might increase in value.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosures

- I currently have an open trade with CMG (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.