CAVA (CAVA) Might Be a UFO!

I always live my life by the classic Earthling saying we always learn as normal human children, “play with your food!”

This food in particular may be a UFO, but first...

What's the Word on the Street?

As of me writing this, the main 3 indexes are largely flat, while the Russell is up. The market is in a wait and see mode as the Economic Policy Symposium begins later this week. The Chairman of the Federal Reserve is expected to give a speech that may hold clues as to what the Fed is thinking regarding future meetings.

Speaking of Fed thoughts, the meeting minutes from last month release on Wednesday. We'll get to see what they thought at the time, notably when several members dissented on whether or not to cut rates (they ultimately didn't cut).

We're also waiting to see what sort of deal (if any) gets accomplished to hopefully stop the war in Ukraine.

Finally, retail earnings from the biggies such as Walmart will give investors another glimpse at how the American consumer is doing.

CAVA (CAVA)

What Is It?

Cava Group, Inc. is a holding company, which engages in the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. It operates through the following segments: CAVA and CAVA Foods. The CAVA segment includes the operations of all company-owned CAVA restaurants. The CAVA Foods segment includes the production of dips and spreads used in CAVA restaurants as well as sales from the consumer-packaged goods (CPG) business. The company was founded by Brett Schulman, Ike Grigoropoulus, Dimitri Moshovitis, and Theodore Xenohristos in 2010 and is headquartered in Washington, DC. The listed name for CAVA is CAVA Group, Inc.

Why Is It a Possible UFO?

Primarily its current share price relative to its fair value and what other option traders expect are the reasons CAVA could be a UFO.

What About Recent News?

CAVA shares took a big hit last week when it released earnings showing a lowered sales growth outlook. Notably, it also reported below forecast same-store sales growth. That's a particularly bad indicator, as it can be a sign of waning consumer interest in the brand. But CAVA plans on opening more stores than expected, which may help its long-term growth.

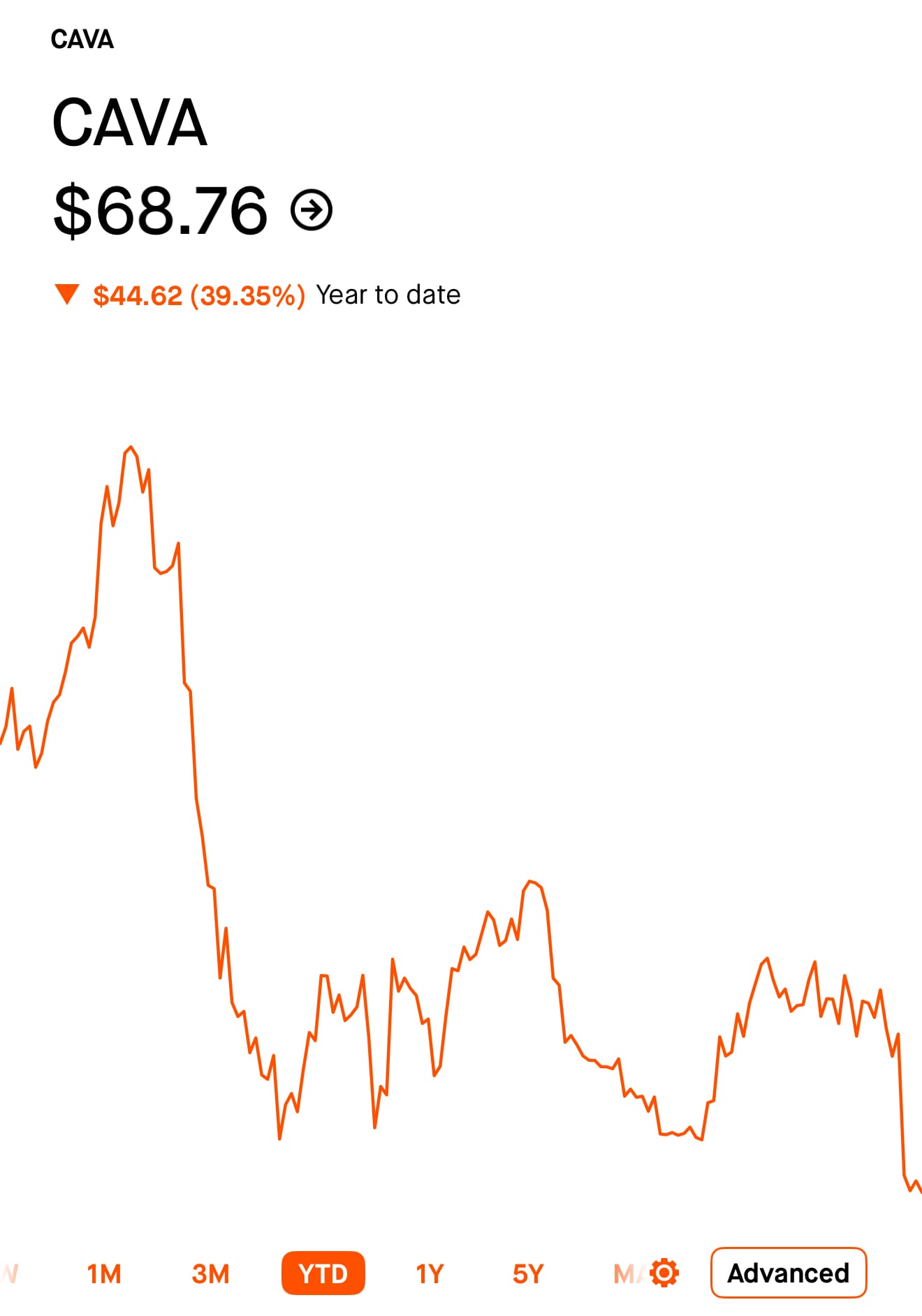

What's the Current Price?

Well obviously CAVA's stock hasn't done well this year. A little over half of that drop was in the past month and ~19% in the past week. I almost picked it up late last week, but decided since it's down again on the day, that it might be a good time pick it up when it's possibly oversold.

What’s the Fair Value?

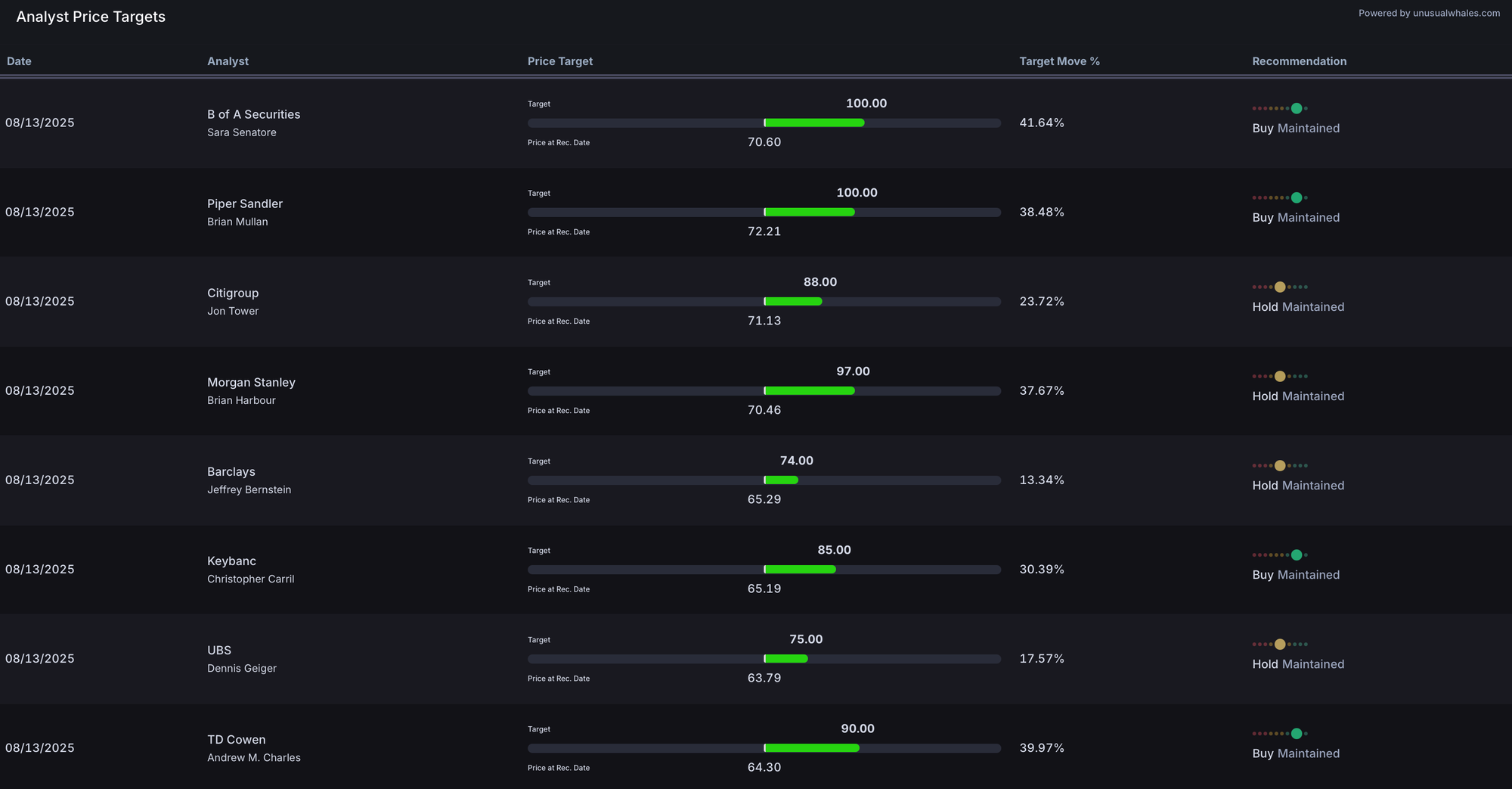

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since CAVA's most recent earnings report on 08/12/2025, it has received 8 ratings and taking the average, the fair value might be somewhere around: $88.63.

4 ratings are a Buy, 4 are a Hold. The lowest price target is $74, while the highest is $100.

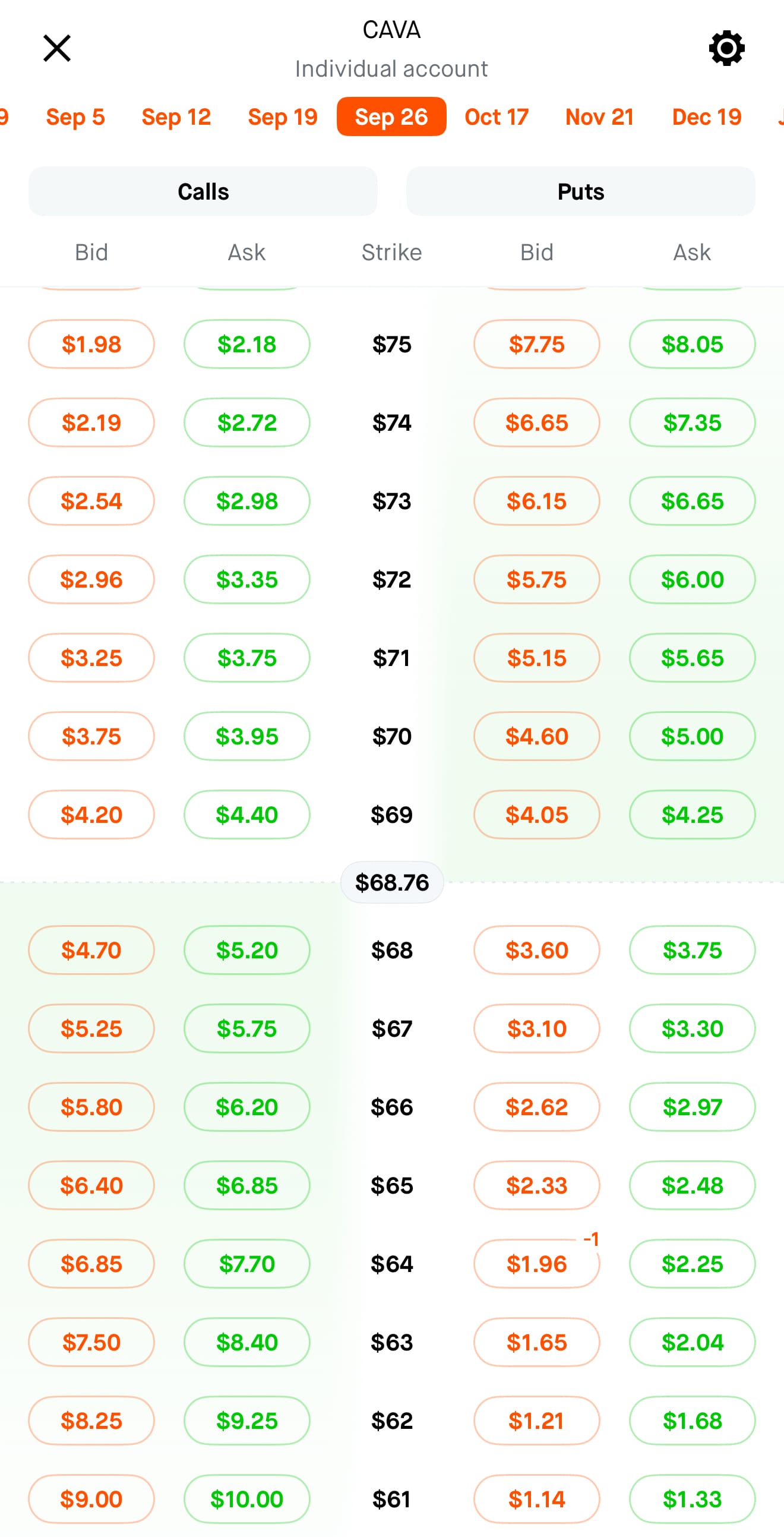

What Do Options Traders Expect?

Calls are trading over equidistant Puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. Notice how on the right side for the $64 Put it says $1.96, it’s $2.54 for the equidistant Call at $73.

The premium (the credit you receive for executing the trade) is currently less for selling Puts, as opposed to selling Calls. Basically because of that, option traders expect the stock to go up, rather than down.

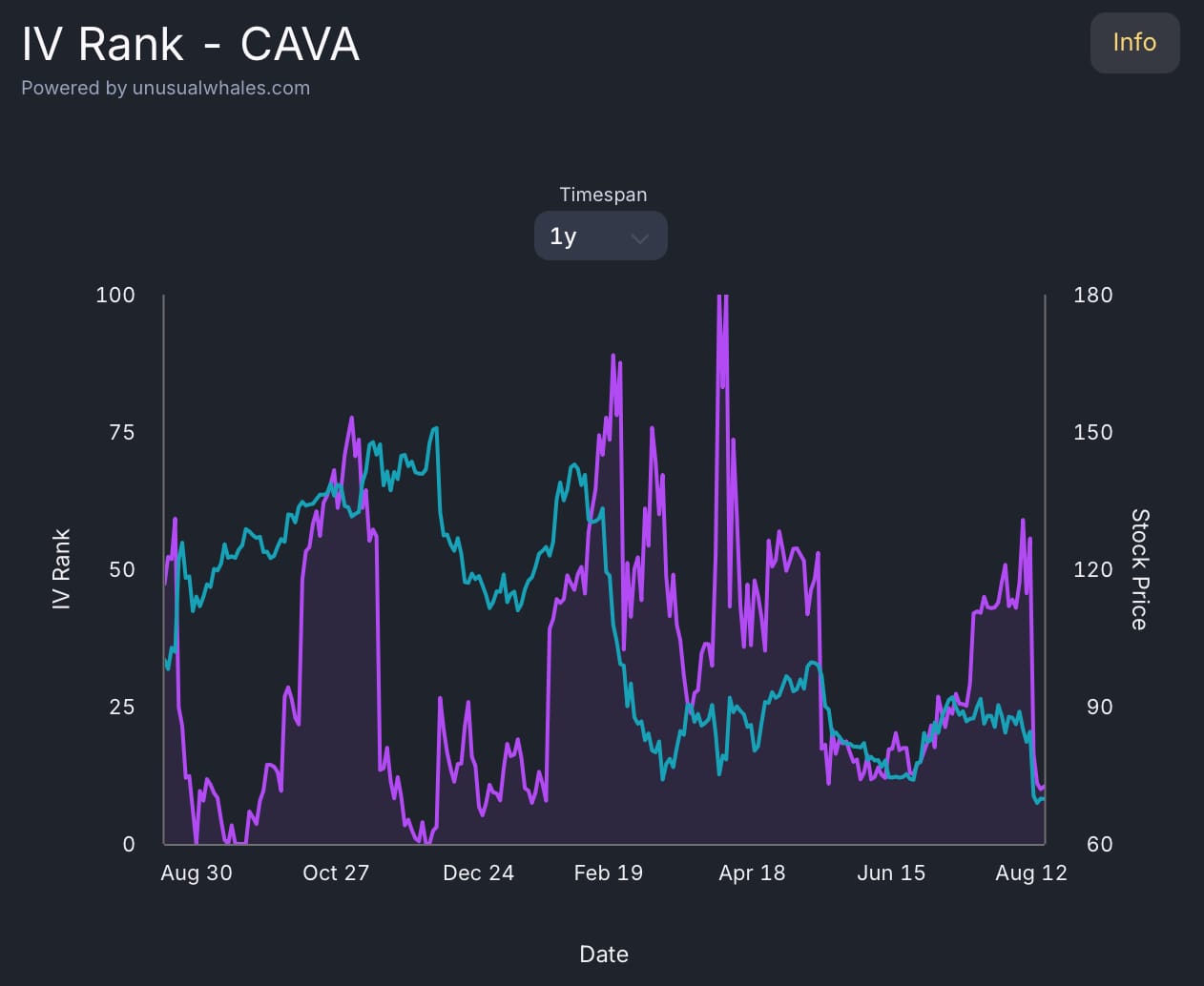

How About Volatility?

The IV rank (the purple line) for CAVA (stock price in blue) is currently hovering around 12.81, which is pretty low (IV rank goes from 0-100). Keep in mind that volatility tends to contract after earnings, but this makes short strategies (which are what I prefer) less attractive.

What's the Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value.

Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

CAVA does not offer a dividend, but that’s not a dealbreaker!

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

So if you saw the most recent image above, I already STO (sold to open) 1 contract of the $64 Put for the September 26th expiration. I like to have a DTE (Days To Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

What About Alternative Trade Ideas?

- If the collateral requirement is too high, another idea is a put credit spread. You would sell a put at a strike below the current share price and then buy a put at a lower strike than the put you sold. By doing so, you will avoid the collateral requirement of a cash-secured put, but the credit received will be smaller. Also, if the trade goes sideways, you will not be assigned shares so no collecting dividends and running covered calls afterwards.

- Just invest! 1 share or even fractional shares are a way to get a foothold in a stock that you think might increase in value.

Alternative Doodle

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know many traders love their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks aren’t necessary unless you’re the kind of trader that wants to try and pick the perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. None are perfect. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosures

- I currently have an open trade with CAVA (as mentioned in this post).

- No trade is a sure thing. There is always risk involved.

- This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.