Archer Aviation (ACHR) Might Be a UFO!

What’s The Word On the Street?

Jobs, jobs, jobs! Today the much anticipated June Jobs Report came in stronger than expected. Honestly the report and the stock market reaction were both a bit of surprise. In previous months, the jobs reports have been weaker and were being revised down, so it will be interesting to see if this jobs report will be revised down next month.

But, it was good news for the economy! And the market ended broadly higher, so why is that a surprise? With U.S. employment in a good place, (the unemployment rate is 4.1% instead of the expected 4.3%), the Federal Reserve is less likely to cut rates soon (much to the chagrin of the President). So the prevailing theory with investors is that the economy is still moving along nicely and worries about a possible recession seem like a distant memory. Plus, it’s a shortened trading day before the holiday weekend and maybe the market is just in a good mood.

Despite all the jubilation, there are still UFOs to spot! And today is…

Archer Aviation (ACHR)

What Is It?

“Archer is designing and developing electric vertical takeoff and landing (eVTOL) aircraft for use in urban air mobility networks. Archer's mission is to unlock the skies, freeing everyone to reimagine how they move and spend time.”

Basically Uber for air travel.

Why Is It a Possible UFO?

I’ve been trading this one over and over. It can have some big swings, but what I like to look for most in a stock is that it‘s undervalued.

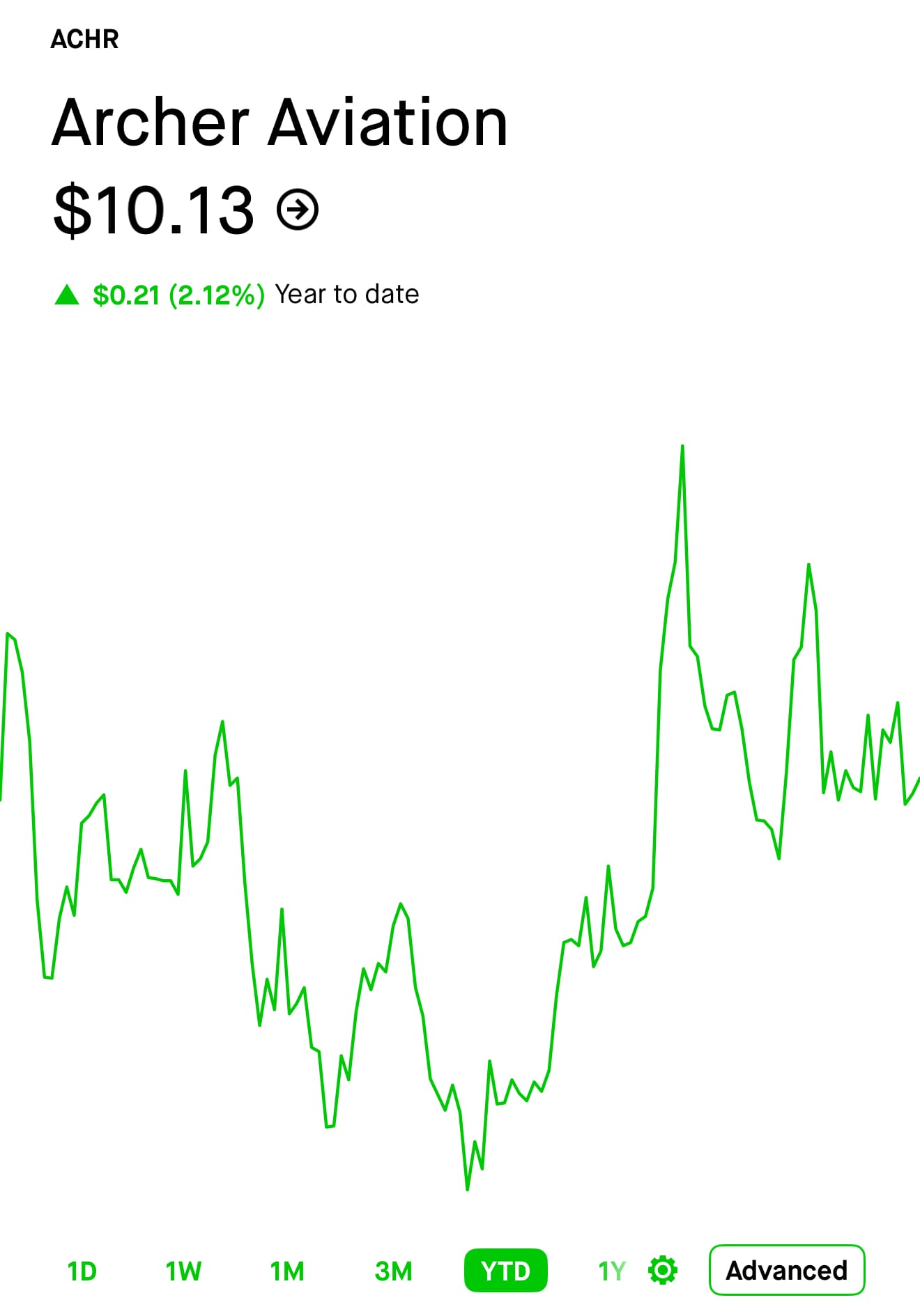

What Is The Current Stock Price?

The price as of this writing is $10.13. It’s only gone up 2.12% this year, but in the past 3 months it’s gone up 51.27% (which is a lot!).

What is the fair value?

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since ACHR’s most recent earnings report on 05/12/2025, it has received 4 ratings and taking the average the fair value might be somewhere around: $14 (Actually $14.125, but I’m rounding down).

What about recent news?

It’s important to take into account what’s going on with a company before trading. All of those analyst ratings could have taken place before some sort of major event occurred. So what’s going on the ACHR recently?

Not that much! Well, nothing major. Things like more test flights, partnerships, raising capital, normal (hopefully) growing business stuff.

What do traders think?

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. See how on the right side for the $8 Put it says $0.25, it’s $0.40 for the equidistant call at $13.

What’s the trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value. Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

ACHR doesn’t offer a dividend because it’s a smaller growth company, but that‘s not a dealbreaker.

So if you saw the most recent image above, I already STO (sold to open) 10 contracts of the $8 put for the August 15th expiration. I like to have a DTE (Days to Expiration) that is around ~45 days.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

In future blog posts, I will expound more on certain concepts/details and provide alternate trade ideas because sometimes the collateral required for my preferred trade is fairly high.

But that’s it for now! This was my first of many posts to come!

Disclosure

I currently have open trades with ACHR (As mentioned in this post).

This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.