Alphabet Inc. (GOOG/GOOGL) Might Be a UFO!

Alphabet Inc. AKA Google, the search and ad behemoth may have been a UFO this whole time! But first…

What’s the Word On the Street?

Over the long holiday weekend the Administration made clear that letters were being sent out to all the countries that haven’t made trade deals with the U.S. yet (which is most of the planet). The deadline for making grand, sweeping trade deals with the entire world is set to expire this week and the implementation is apparently happening on August 1st. Who knew that 90 days wasn’t long enough to fix the chaos of upending the entire landscape of global trade?!

Well given that, investors weren’t very pleased and the week has started in the red. The Treasury Secretary claims deals are on the way and the market isn‘t convinced yet. But that’s ok, there are still UFOs to trade!

Alphabet Inc. (GOOG/GOOGL)

What Is It?

“Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.”

Why Is It a Possible UFO?

Several reasons! Its current share price relative to its fair value, its volatility, what other option traders expect for the stock are the highlights.

What About Recent News?

Alphabet Inc. has been under a lot of regulatory scrutiny lately. Most notably it’s facing a possible breakup due to its supposed monopoly in the online ad market. It could be forced to sell off the Chrome browser.

Otherwise, they are doing their best to keep up in the AI race with their Gemini AI. They have to because their dominance in the search business stands to be eclipsed as younger users are reportedly relying more on ChatGPT and other AI to search (not to mention TikTok and other social networks that aren’t YouTube).

All of that sounds…not great, but I feel like it’s been in the news cycle for so long, most or all of it is baked into the stock price. It’s a laggard lately compared to the other Magnificent 7 technology stocks and people are still using search and YouTube. Not to mention Waymo (Alphabet’s autonomous driving company) has been increasingly expanding into new cities.

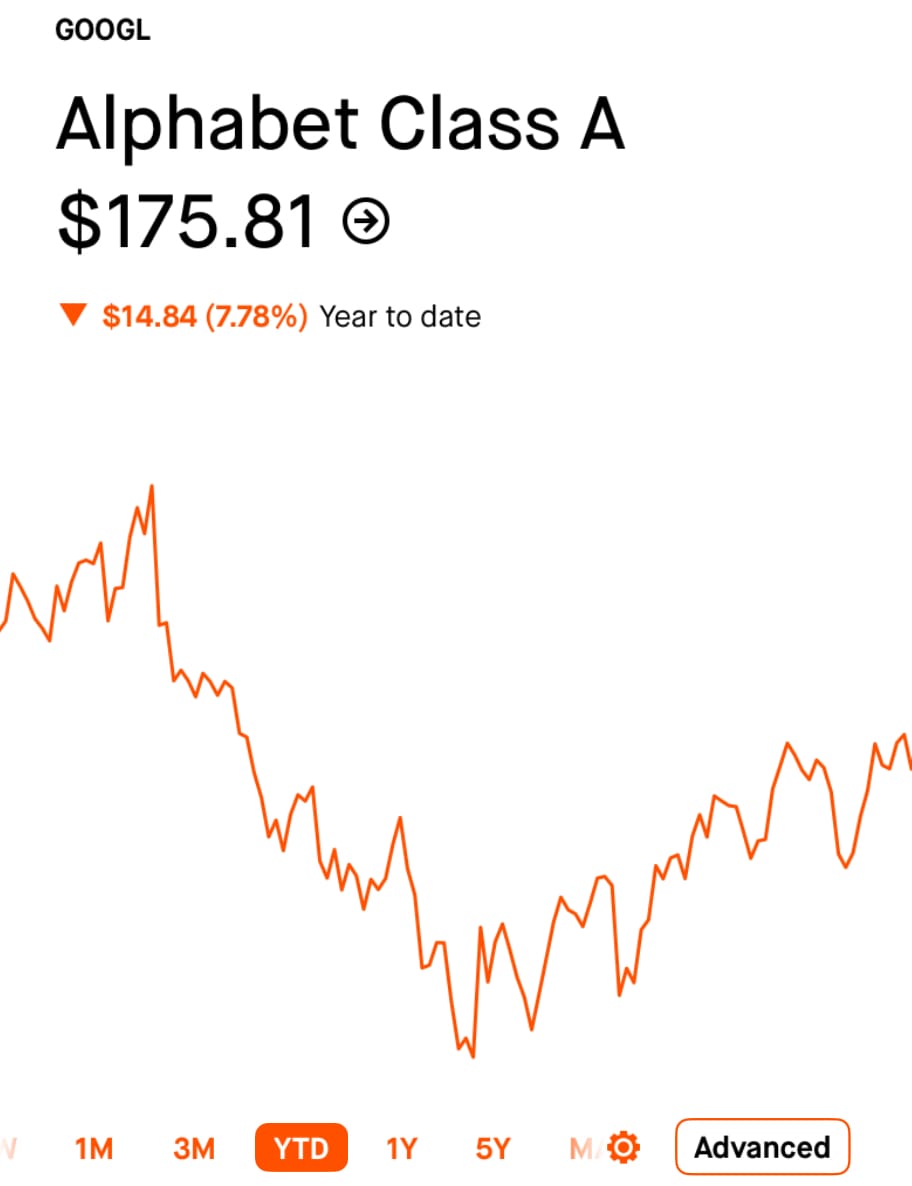

What’s the Current Price?

I’m going to be looking at GOOGL as opposed to GOOG for the purposes of this post. They are essentially the same, except that GOOGL is what I have shares in and it allows holders to have voting rights, so it trades at a slight premium compared to GOOG.

With that in mind, GOOGL (as of this writing) is currently $175.81/share. Down -7% YTD (year to date), but up ~24% in the past 3 months.

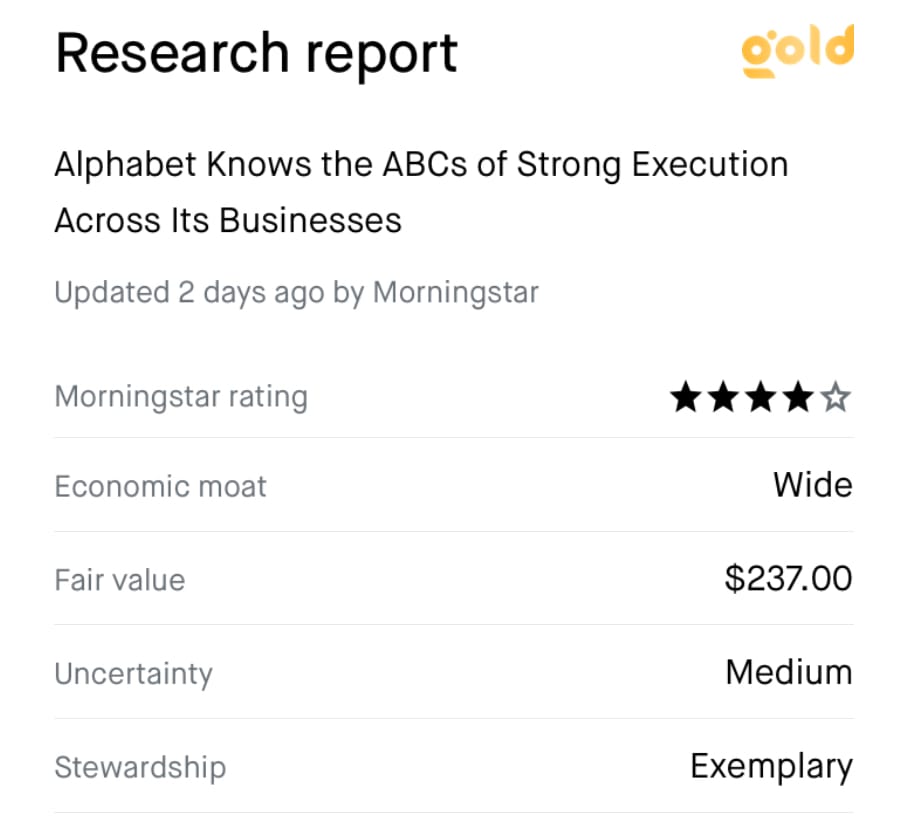

What’s the fair value?

Two images with a rating from Morningstar and a list of more from other various rating firms

I’d first like to emphasize that fair value is subjective. Many analysts at many banks and institutions rate stocks differently and assign fair value in their own unique way. So, what I like to do is take all the recent fair values since the most recent earnings report and average them. In this case…

Since GOOGL’s most recent earnings report on 04/24/2025, it has received 15 ratings and taking the average the fair value might be somewhere around: $214 (Actually $214.33, but I’m rounding down). 9 of the ratings are a buy and 6 are a hold.

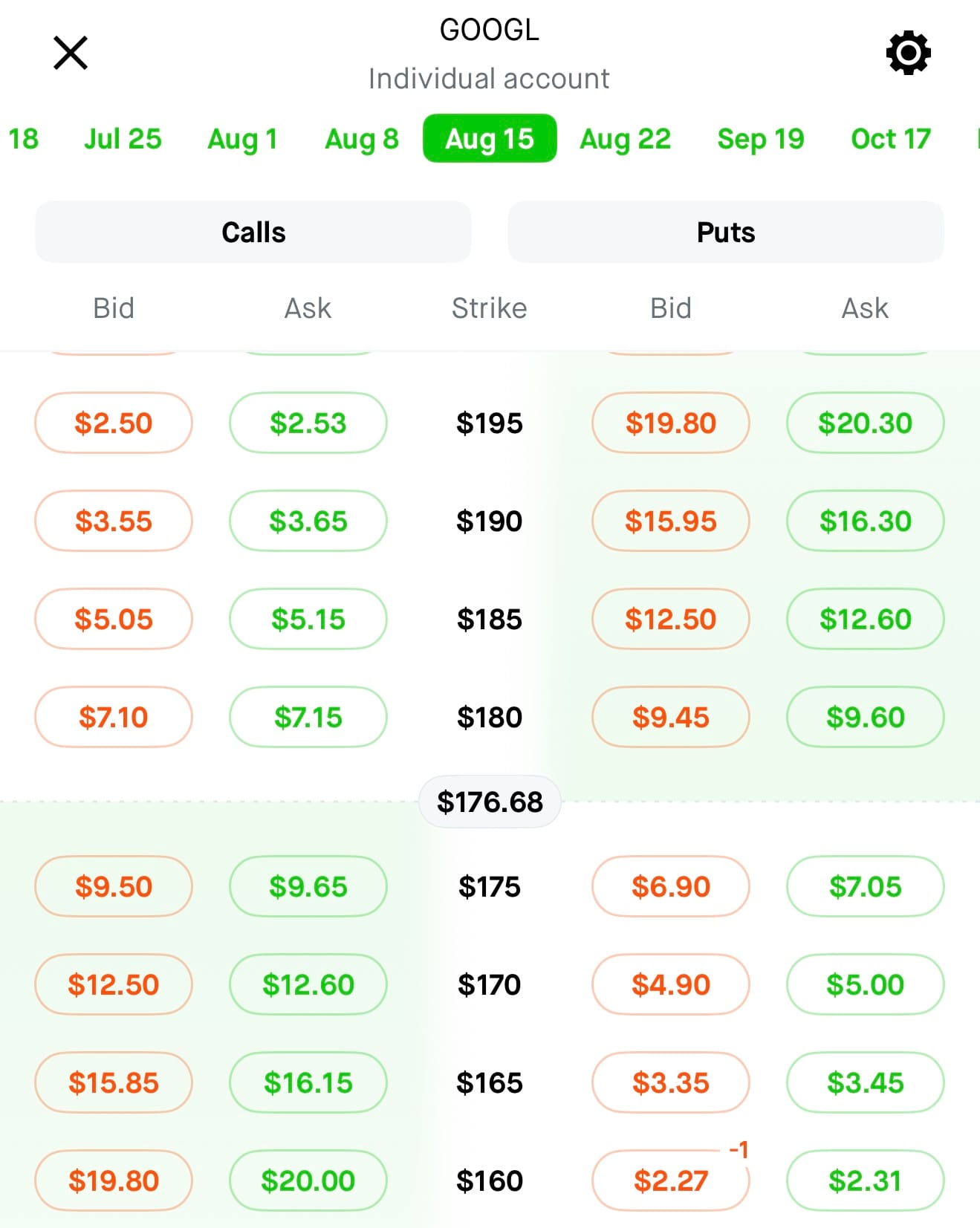

What Do Options Traders Think?

Calls are trading over equidistant puts, which means traders think there is a chance to the upside. You can see because… forget about the green columns and focus on the red. See how on the right side for the $160 Put it says $2.27, it’s $2.50 for the equidistant call at $195.

Note: After originally screenshotting that, the market fell further (along with GOOGL) and the calls to equidistant puts shifted slightly in the reverse. That kind of thing happens and it’s ok! It doesn’t mean the trade will be unprofitable or lead to assignment. The market is going to be bumpy this week due to the trade deal deadline.

How about volatility?

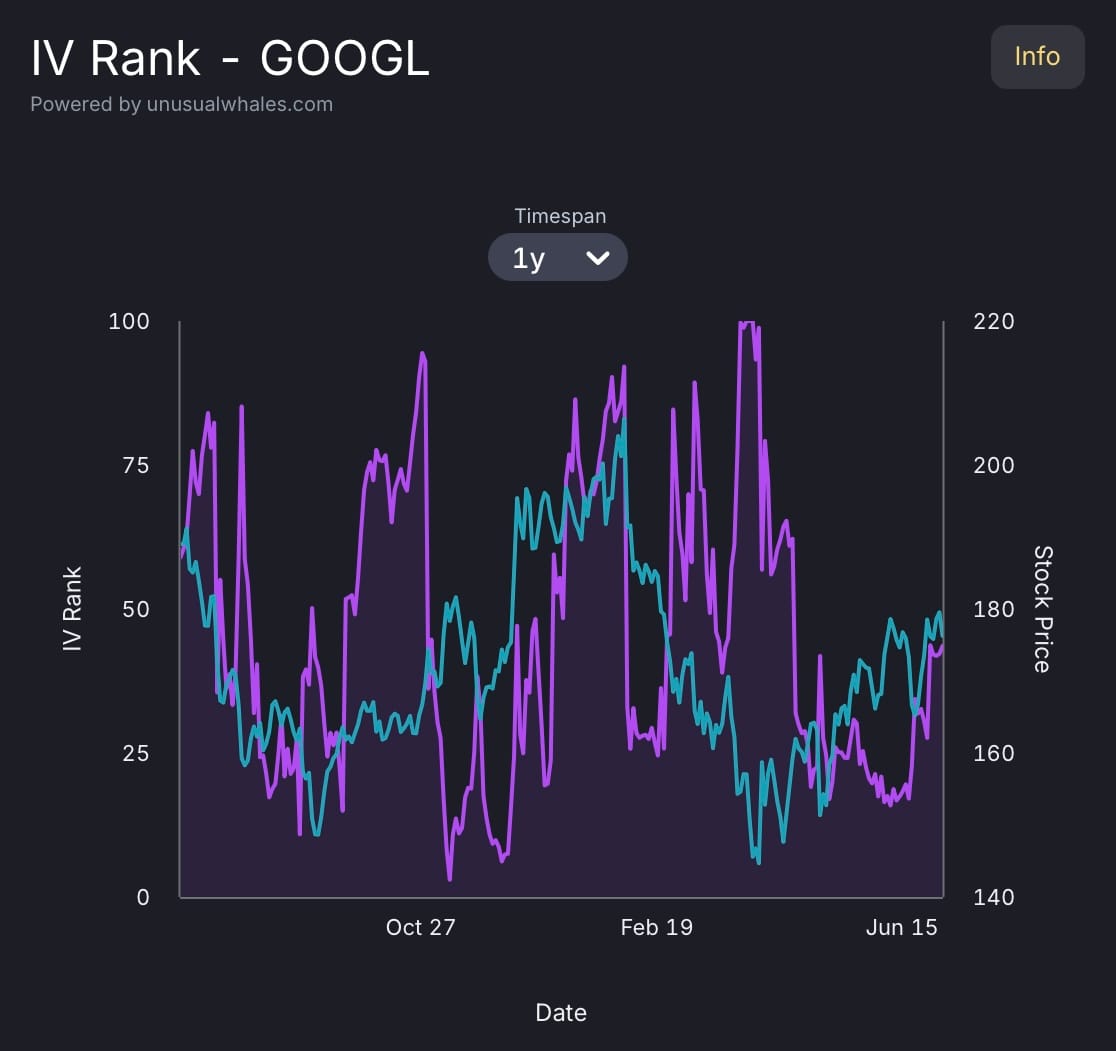

The IV rank for GOOGL is currently 44.87 which is pretty good for my preferred strategy of selling puts. Keep in mind it’s better to sell options when volatility is high.

What’s The Trade?

My preferred trade is a variation of the wheel without the rolling, AKA cash-secured puts. I typically like to target stocks that offer a dividend and are below fair value. Why a dividend? If the trade results in assignment and I’m on the hook for X amount of shares, I can at least be satisfied knowing I picked a (hopefully under fair value) company that will pay me a small amount while I run the other side of the trade AKA covered calls.

It’s a fairly low-risk strategy (all options trading is risky!), that has a higher probability of success, but requires a higher amount of collateral.

GOOGL does offer a dividend, but the yield is pretty low (0.45%), but something is better than nothing!

So if you saw the most recent image above, I already STO (sold to open) a contract of the $160 put for the August 15th expiration. I like to have a DTE (Days to Expiration) that is around ~45 days. I know the August 22nd DTE is closer to 45 days, but there is more volume for the third Friday of the month right now.

When the trade reaches 50% profit I will buy it back. I don’t like to be greedy and go for more profit, because I would rather not waste my time being in a trade for too long.

Wait…Where Are the Candlesticks? And All the Other Indicators?

I know every trader on the planet loves their candlesticks and a ton of indicators. I prefer simplicity. Candlesticks are hardly useful to me unless you’re the kind of trader obsessed with picking the absolute perfect moment to execute a trade, and even then it’s not a sure thing.

As for indicators, there are a ton. Some of them work sometimes. I don’t want to get bogged down with too many. You’ll drive yourself crazy looking at too many of them, so find a handful you like and stick with those.

Disclosure

I currently have open trades with GOOGL (as mentioned in this post).

This blog post is not meant to take the place of financial advice, but hopefully acts as a guide for learning or informational purposes.